High quality development is the fundamental strategy for preventing and resolving risks

Li Yunze stated that preventing and resolving financial risks is an eternal theme of financial work, which is related to national security, overall development, and people's property security. It is a major gateway that high-quality development must cross. As a financial regulatory department, preventing and resolving financial risks is our primary responsibility. We will resolutely implement the spirit of the Central Financial Work Conference, firmly follow the path of financial development with Chinese characteristics, and firmly guard the bottom line of preventing systemic financial risks.

Li Yunze stated that there are three simple sentences regarding the question of "how to view the risk situation":

The first sentence: Currently, the overall financial risks in China are controllable, and the banking and insurance industries are operating steadily, especially the major financial institutions. It can be said that the basic situation of China's financial security is very stable.

Whether compared to international or domestic regulatory standards, the main physical examination indicators of China's financial industry are in a healthy range. As of the end of last year, the non-performing loan ratio of China's banking industry was 1.6%, the provision coverage rate was 205%, the capital adequacy ratio was 15%, and the insurance solvency adequacy ratio was 197%. Although there are high-risk small and medium-sized financial institutions in some places, their proportion in the entire financial industry in China is very low, both in terms of overall quantity and individual scale. Moreover, we are actively working with relevant local party committees and governments to implement precise policies and effectively and orderly promote the resolution of risks.

The second sentence is, to deal with risks, we have sufficient resources and conditions. Our country has the political advantage of centralized and unified leadership by the Central Committee of the Communist Party of China, as well as the institutional advantage of concentrating efforts to accomplish major tasks. Especially, the basic trend of long-term economic growth in our country has not changed. This is the greatest confidence, strongest support, and most powerful guarantee for us to prevent and resolve financial risks. The total capital and provisions of China's banking and insurance industries exceed 50 trillion yuan, and we also have financial stability guarantee funds and various industry protection funds. It can be said that we have a very solid foundation to resist risks.

In addition, we have more diverse tools and means to prevent and deal with financial risks, especially after last year's Central Financial Work Conference, the working mechanisms for various risk prevention and disposal have been further improved. We have full confidence, conditions, and ability to maintain the country's financial security.

The third sentence is that development, especially high-quality development, is the fundamental strategy for preventing and resolving risks. Finance itself is an industry with operational risks, and the key is to effectively control risks and prevent economic and financial fluctuations. More than 20 years ago, several large state-owned commercial banks in China also faced significant risks and challenges. Later, after restructuring, restructuring, and going public, they not only effectively resolved the risks, but now their comprehensive strength ranks among the top in the world. We need to establish a correct view of risk, view risks with a developmental perspective, examine risks with dialectical thinking, and achieve high-quality development of finance itself in the process of serving the high-quality development of the economy and society.

Regarding risk prevention and control, Li Yunze stated that the current focus is to make great efforts to improve the "four qualities":

Firstly, foresight means playing the first move well and taking the initiative. We will further improve the prevention and control mechanism covering the entire process of source governance, early correction, and recovery and disposal, to achieve early identification, early warning, early exposure, and early disposal of risks. At the same time, we will further accelerate the construction of regulatory big data platforms, create "thousand mile eyes and smooth ears", and further improve the digitalization and intelligence level of regulation.

Secondly, accuracy, grasping substantive risks, and solving practical problems. We will tailor measures to local conditions, implement classified policies, and accurately dismantle bombs, actively resolve existing stocks, resolutely curb incremental growth, fight tough and protracted battles, and continue to promote the reform and insurance transformation of high-risk small and medium-sized financial institutions. At the same time, we will also grasp the timing and effectiveness of preventing and disposing of financial risks, prevent the occurrence of disposal risks, and ensure the stability of the overall economic and social situation.

Thirdly, effectiveness refers to adhering to strong and strict supervision, and comprehensively strengthening the five major regulations. We will focus on promoting the construction of the basic rule of law in financial regulation, accelerating the filling of institutional shortcomings and weaknesses, and further improving the enforcement efficiency of regulation. Especially, we will closely monitor key issues, key individuals, and key behaviors, and seriously investigate and deal with illegal and irregular issues that disrupt financial stability and cause significant risks.

Fourthly, synergy should be promoted to form a joint regulatory force, and all financial activities should be included in regulation in accordance with the law. We will take the lead in establishing a regulatory responsibility attribution and bottom-up supervision mechanism, and accelerate the promotion of relevant work requirements that must manage risks, legality, and illegality in the regulatory industry. At the same time, we will further increase coordination and linkage with local party committees and governments, truly achieving shared responsibilities, answers to questions, and efforts in the same direction.

"Here, I would like to take this opportunity to remind financial consumers to be highly vigilant against illegal financial activities that involve various renovations. I also hope that the news media can work with us to promote prevention and crackdown on illegal financial activities, and jointly safeguard the people's wallets," said Li Yunze.

Improving the Quality and Efficiency of Serving the Real Economy through "One Rise and One Fall"

When answering the reporter's question about "how to guide the banking and insurance industries to provide high-quality services for social and economic development," Li Yunze pointed out that the real economy is the foundation of finance, and finance is the bloodline of the real economy. The two complement each other, coexist and prosper together. "In recent years, in accordance with the deployment requirements of the Party Central Committee and the State Council, we have continuously guided financial institutions to return to their roots, focused on their main business, continuously optimized financial supply, and played an important role in helping the economy recover and improve. Overall, it can be summarized as" one increase and one decrease ":"

"Yisheng" refers to the continuous improvement of the quality and efficiency of serving the real economy, and the continuous expansion of the coverage of financial services, from the northernmost to Mohe and the southernmost to Sansha, achieving the goal of having branches in every township and providing services to every village.

The total assets of China's financial industry have exceeded 460 trillion yuan, and the supply of funds to the real economy has steadily increased. Last year, RMB new loans increased by 1.3 trillion yuan year-on-year, and the loan growth rate in some key areas such as high-tech, small and micro enterprises, green and low-carbon, and advanced manufacturing exceeded 20%. The insurance coverage capacity continues to improve, with insurance payout expenses reaching 1.9 trillion yuan, a year-on-year increase of 21.9%. Especially in last year's catastrophic flood in the Beijing Tianjin Hebei region, insurance early compensation, fast compensation, advance compensation, and full compensation have paid 12.6 billion yuan, fully reflecting the role of the insurance industry as an "economic shock absorber" and "social stabilizer".

"One reduction" refers to the continuous reduction of social comprehensive financing costs, the lowering of loan interest rates to historical lows, and the lowering of bank net interest margin to the lowest level in 20 years. Last year, in conjunction with the People's Bank of China, we pushed for a decrease in interest rates on existing first-time home loans, which can save interest expenses of 170 billion yuan annually for homebuyers. At the same time, we actively urge banks to reduce fees and benefits. Bank transaction fees have been decreasing for three consecutive years, and the comprehensive reform of car insurance has also saved over 300 million policyholders over 140 billion yuan in annual premium expenses.

Li Yunze said that we are well aware that there are still many shortcomings and weaknesses in financial services for the real economy. The current key is to promote the circulation of funds, capital, and assets, smooth out the bottlenecks and bottlenecks in the process of fund circulation, solve the problem of having funds but not capital, and patiently lack capital, truly opening up the "dual pulse" of social fund circulation.

Li Yunze stated that in the next step, we will continue to deepen the financial supply side reform in accordance with the deployment of the government work report, do a good job in five major articles, and provide stronger financial support for high-quality economic development. Mainly responsible for the following three aspects of work:

Firstly, we must serve the new quality productive forces. This is a key focus of financial support for high-quality development, and we will fully support technological innovation. In January of this year, we have issued a document specifically to provide financial services throughout the entire lifecycle for technology innovation enterprises. At the same time, we are actively researching using financial asset investment companies as platforms to further expand the scope of equity investment pilot projects and increase support for science and technology innovation enterprises. We will fully support green development, further enrich diversified product and service systems such as green credit, green insurance, green leasing, and green trust, and assist in green and low-carbon transformation. We will fully support future and emerging industries, while actively promoting the digital and intelligent transformation of traditional industries, shaping new driving forces and advantages for development.

Secondly, we need to serve effective needs. In terms of consumption, we will guide financial institutions to actively promote new types of consumption, expand traditional consumption, and support the trade in of consumer goods. Recently, we are studying reducing the down payment ratio of passenger car loans and further optimizing the pricing mechanism of new energy vehicle insurance to help cars enter millions of households. In terms of investment, we will further increase the funding supply for key projects and major projects, while promoting the implementation of urban real estate financing coordination mechanisms and actively supporting the construction of three major projects, including affordable housing. In terms of foreign trade, we will actively support the export of new energy vehicles and other "new three types" as well as overseas warehouse layout, providing them with more targeted comprehensive financial services, and gradually expanding the coverage of export credit insurance.

Thirdly, serving people's livelihood security. In terms of inclusive finance, we are deploying special actions to promote the expansion and sinking of small and micro loans, while increasing support for private enterprises on an equal footing. In terms of elderly care and health, we will quickly make up for the shortcomings of the third pillar, further enrich the supply of elderly care financial products, and accelerate the development of long-term care insurance and other health insurance. At the same time, we encourage insurance institutions to create exclusive insurance products for flexible employment groups such as delivery drivers and ride hailing drivers. In terms of disaster prevention and reduction, we will further expand the coverage of agricultural insurance, and develop catastrophe insurance tailored to local conditions. We will also further increase support for post disaster reconstruction.

Li Yunze said that the two sessions have come to a successful conclusion, and the next step is to vigorously implement them.

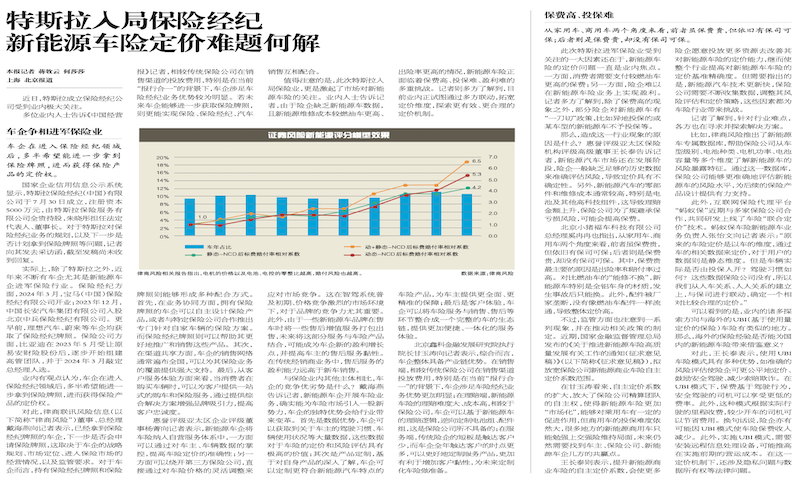

Tesla enters the insurance brokerage and how to solve the problem of new energy vehicle insurance pricing

Tesla enters the insurance brokerage and how to solve the problem of new energy vehicle insurance pricing