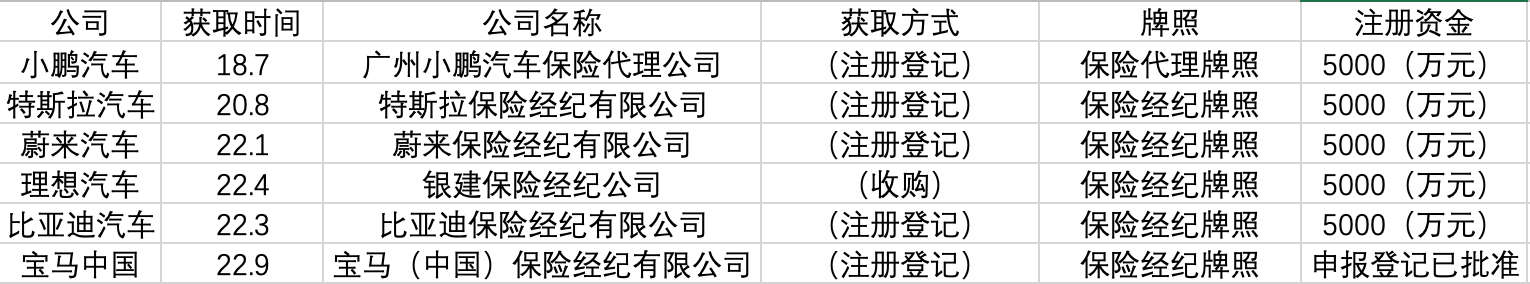

First, the new and old car giants have "directly" taken the insurance brokerage license

At present, many car companies have directly invested in the establishment of insurance companies or insurance intermediary companies, or invested in insurance companies, aiming to deepen the layout of the insurance sector. For example, large manufacturers such as SAIC, GAC, FAW, and Geely all participate in insurance or brokerage companies to serve their own automotive ecosystems. And Tesla, Xiaopeng, Weilai, ideal and other new car-making forces, are also actively setting up insurance intermediary companies (including brokerage companies and agency companies), although the pace of the layout is different, but lock in the insurance field, enrich the automotive aftermarket service, is obviously a consensus.

Car insurance is a very good platform "entrance", as the first service product that consumers are exposed to when buying a car, it is both a just need and the only attribute product. In the past, the automobile sales terminal was mainly controlled by dealers, so the automobile dealer channel has also become the most important sales channel for automobile insurance. Over the years, the main contribution of the insurance growth rate of the head property insurance company has come from this, and the just-needed attributes and stickiness of auto insurance have enabled dealers to control the car owner service entrance, thereby expanding the auto aftermarket business such as auto maintenance, claim repair, and auto finance.

Based on the perspective of the whole machine factory, in the absence of an insurance license or insurance intermediary license, according to the needs of providing continuity services, it is necessary to cooperate with third-party insurance companies, and most of the profits are divided, and if you are directly involved, you can strive for greater profit margins. In addition, automotive OEMs involved in insurance can also extend their own industrial chain, optimize all aspects of the industrial chain, and explore new profit points. Through the services and products of the automotive "aftermarket", increase user stickiness, especially by taking advantage of the professionalism of vehicle loss determination and spare parts, as well as the reliability of vehicle operation data and maintenance data sources, and deepen the cultivation in the aspects of car insurance accuracy, differentiated pricing and exclusive insurance, to create new business growth points.

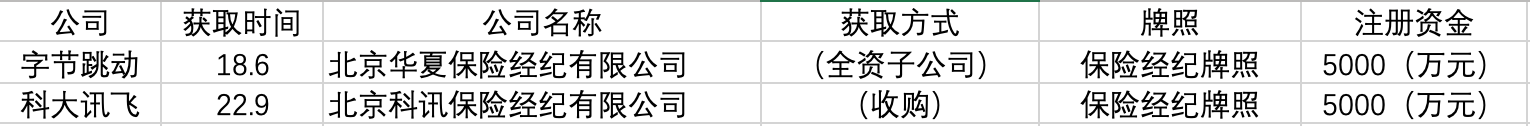

Second, technology companies test the water "technology + flow" dual monetization model

Many technology companies have entered the insurance industry by acquiring insurance brokerage licenses to "save the country" and explore systematic innovation to drive intelligent applications of insurance technology to expand their business extension. This type of technology company mainly provides a full-link service system of front-end "accurate customer acquisition" and "intelligent underwriting" for insurance products through the model of "AI+big data + customized products", "intelligent claim settlement and intelligent claim verification" on the claim side, and "characteristic service" on the service side. Taking the national-level explosive product "Huimin Bao" as an example, iFLYTEK tested the water of Anhui Huimin Insurance through the hybrid marketing model of artificial intelligence online and offline collaboration, and the number of insured people exceeded 2.3 million in 100 days of on-line, and the peak number of insured persons in a single day reached 180,000, which greatly improved operational efficiency and effectiveness.

Third, in the era of industrial Internet, "insurance +" may become the second curve of the growth of technology companies

First, technology companies and insurance companies cooperate strategically to promote the application innovation of "AI + big data + insurance". The two sides can achieve progressive results in many areas of "AI + big data" such as government, education, healthcare, automotive, and other industries. It can help technology companies better serve the majority of users, empower financial enterprises and industry ecological partners that support cooperation in the banking and insurance industries;

The second is to enhance the focus of their own strategy. In the fields of education, medical treatment, consumption and other tracks, artificial intelligence technology has realized the benign interaction and large-scale application of source technological innovation and industrial application, and continues to open up a new market space. For example, ByteDance can actively empower financial institutions in terms of intelligent customer acquisition and accurate recommendation, and create phenomenal products in the financial industry;

The third is to consolidate the foundation of technology companies in the innovation and development of the financial technology industry. Leading companies such as ByteDance and iFLYTEK have maintained extensive cooperation with major domestic financial enterprises, and the current solutions and applications have covered the fields of intelligent customer service, intelligent marketing, intelligent operation, intelligent risk control, and intelligent office. Through image recognition, AI voiceprint recognition and other technologies, all reporting systems are factorized, collided, and clustered, so as to find suspected cases, improve the anti-fraud ability of insurance companies, and enhance industry profits and brand credibility.

addition, the "insurance +" model has a strong boost in many directions such as helping the new pattern of rural revitalization and achieving the double carbon target. It is foreseeable that insurance, an ancient industry with a history of more than 600 years, will collide with many wonderful things in today's industrial Internet.

addition, the "insurance +" model has a strong boost in many directions such as helping the new pattern of rural revitalization and achieving the double carbon target. It is foreseeable that insurance, an ancient industry with a history of more than 600 years, will collide with many wonderful things in today's industrial Internet.