Looking ahead to 2024, it is foreseeable that fintech will continue to advance along the dynamic and innovative track of technology empowerment. With the continuous progress of technology and the deepening of applications, financial technology will not only greatly improve the efficiency and convenience of financial services, but also enhance their inclusiveness and accessibility through diversified technological innovation. More people will be able to access financial services that were previously difficult to reach, promoting financial inclusiveness while reconstructing the pattern of financial service innovation.

Policy direction guidance, abundant momentum for implementation. According to the clear goal of building a strong financial country proposed at the Central Financial Work Conference, achieving this goal requires accelerating the improvement of the financial industry's service capabilities around five major articles: technology finance, green finance, inclusive finance, pension finance, and digital finance. From the perspective of insurance, as the main tool for risk management in the whole society, whether it is in the fields of rural revitalization, elderly care, medical care, or digital insurance continuously consolidating the functions of social stabilizer and risk regulator, the role of modern insurance has been redefined.

The era of big insurance is approaching, and risk reduction management is gradually entering a better stage. With the advancement of technology, more insurance practitioners will gradually realize that the industry has entered the era of "big insurance" in 2024. With the help of cutting-edge technology tools such as generative AI and big data, we continuously embed them into the entire insurance value chain and multiple scenarios. The investment in industry information construction continues to increase, and the digital transformation of the entire industry is further deepened. Innovation in areas such as products, channels, and models is prominent, and under the background of new technologies, many previously uninsurable and insufficiently insured production and life fields have generated new value effects, such as customized insurance and technology applications in areas such as cybersecurity insurance and agricultural insurance, as well as active defense services and intelligent services in the field of car insurance.

Technological iteration continues, and new species of fintech continue to emerge. 2024 is expected to become a more active and innovative year in the fintech field. With the further maturity and deep application of these technologies, fintech will continue to expand its scope of influence, providing more possibilities for the diversification and personalization of financial services.

In 2024, it is expected that embedded finance will lead a significant transformation, deeply integrating into various platforms in the non-financial field. This year, the industry will witness various innovations such as loan services provided by e-commerce websites and payment functions launched by social media platforms, all of which mark the rapid development of embedded finance.

Countries are also exploring or planning to launch their own digital currencies, indicating a fundamental change in the digital currency field in 2024. Especially in China, with the widespread promotion and application of digital renminbi, it is expected to play a significant role in improving financial inclusivity, reducing transaction costs, and has the potential to completely change existing cross-border payment methods.

In addition, personalized applications of artificial intelligence and machine learning are leading industry transformation. These advanced technologies continuously enhance the personalization of financial services, enabling financial institutions to provide customized investment portfolio management, more efficient risk control, and improve overall operational efficiency. It plays a crucial role in identifying and preventing fraud, greatly enhancing the security of financial services. Artificial intelligence chatbots will also become an indispensable part of financial technology applications, providing people with real-time assistance and personalized service suggestions, thereby improving customer experience and satisfaction.

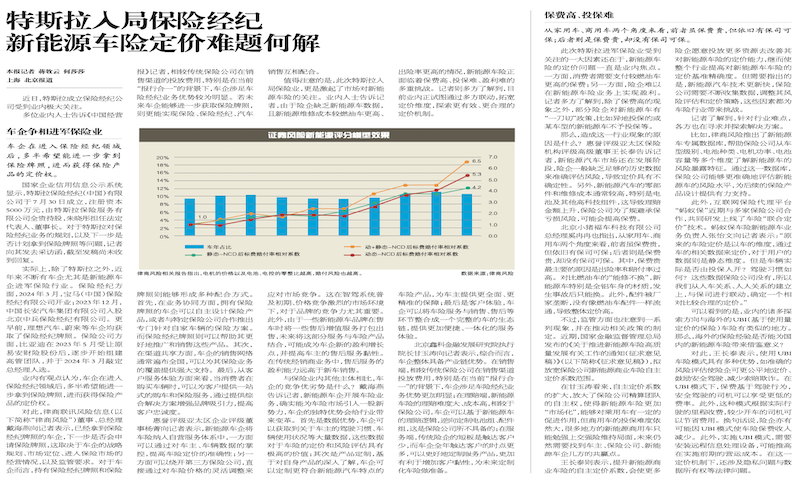

Tesla enters the insurance brokerage and how to solve the problem of new energy vehicle insurance pricing

Tesla enters the insurance brokerage and how to solve the problem of new energy vehicle insurance pricing