Introduction:

The overall situation of the world is a vast soup. Technology empowerment is a historical choice for the new era of insurance. With humanity entering the digital age, the deep transformation of the insurance industry is closely accompanied by technological evolution and is moving forward with great strides. Insurance technology, as an absolute mainstay in the field of financial technology, has always played an important role, and is highly sought after by investment institutions due to its unique industry attributes such as multiple scenarios and heavy innovation.

The total amount of global insurance technology financing for the whole year of 2022 has exceeded that of 2020, which is particularly rare in the current rapidly changing external environment. According to a survey conducted by Accenture, 66% of global insurance industry executives have reported that insurance companies are accelerating their business transformation towards digitization; 80% of insurance industry executives believe that insurance companies' business strategies are becoming increasingly intertwined with technological development, and are at an equally important level.

In the broader world of demand breakthroughs, insurance technology still has great potential!

Current Development Status of Insurance Technology Industry at Home and Abroad

Global insurance technology enters a new era

UK: A Pioneer in Regulatory Innovation: The Diversified Development Model of Insurance Technology in the UK

Based on hundreds of years of industry accumulation, the UK was the first to introduce a regulatory sandbox system. Insurance technology in the UK has gradually shown a trend of diversified development. The regulatory sandbox allows financial innovation within a certain space, and by changing regulatory authorities, it can break free from the passive position of regulation in the process of active innovation in the market. Different enterprises are committed to research and development in different technological directions and management models, resulting in unique product styles and operational technologies, presenting an industry trend where cooperation outweighs competition.

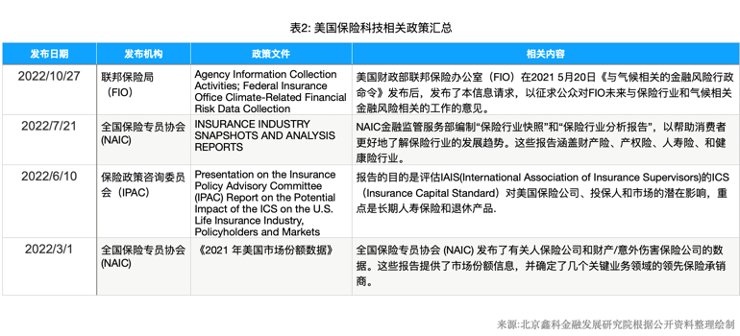

The United States: "The Dual Competition of Technology and Regulation: Challenges and Opportunities of Insurance Technology in the United States"

The innovation consciousness in the United States has a significant impact on the development of insurance technology. The government has established an additional technical working group to timely obtain and analyze data on the latest industries and development trends in the market. The Federal Insurance Office of the Ministry of Finance manages its subordinate states and requires them to emphasize the importance of data security for personal rights to customers. However, there is still no consensus on the specific regulatory model for fintech business in the United States, and there is a problem of unclear power and responsibility boundaries among major regulatory agencies. There are conflicts in regulatory powers between the federal and state levels, and the new type of license plate led by the federal level is difficult to bypass state regulatory agencies for smooth implementation. In such a dual regulatory model, not only is it impossible to simplify the current regulatory model, but it also hinders the dissemination of information among regulatory agencies.

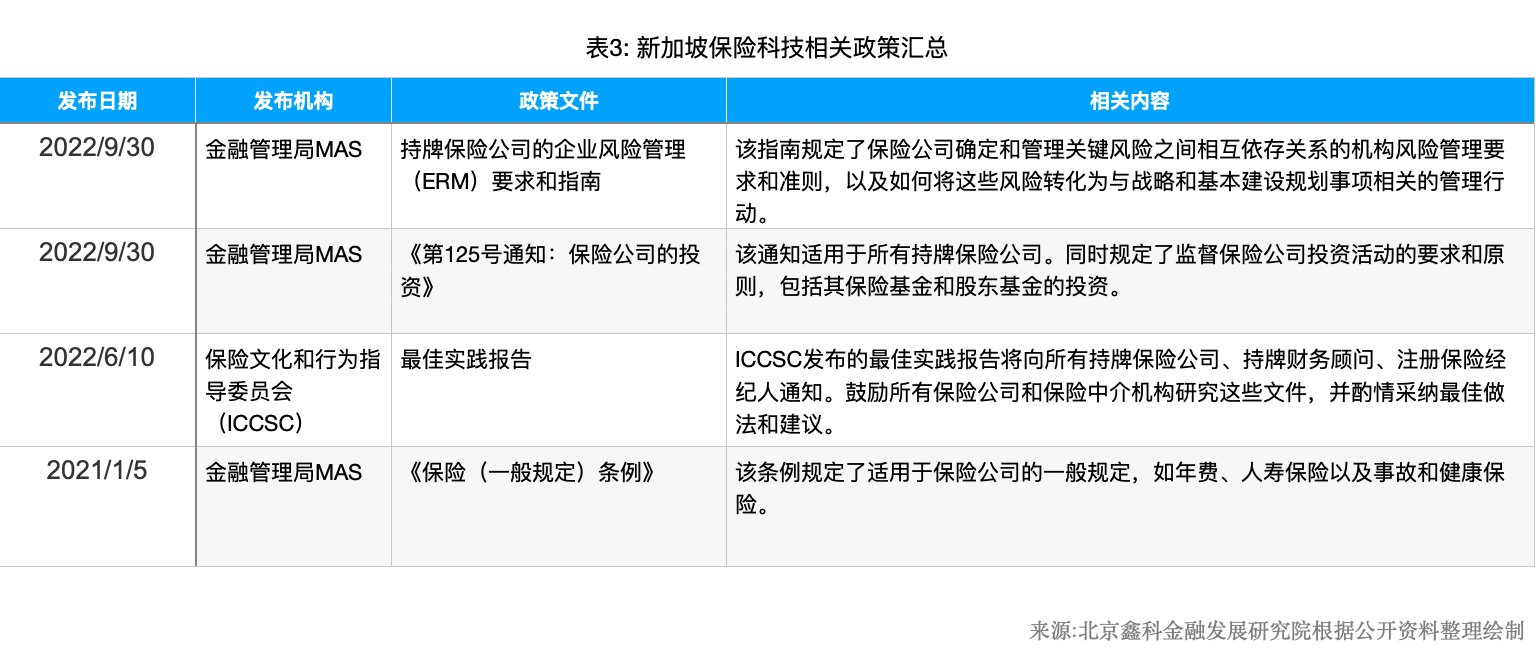

Singapore: Pioneer of Intelligent Finance: Strategic Positioning and Global Influence of Singapore Insurance Technology

In order to promote fintech innovation, the Singapore government continuously formulates policies to support the development of fintech enterprises, focusing on the construction of global smart technology centers and smart financial service centers. The Monetary Authority of Singapore (MAS) has also launched various projects such as Green Financial Technology, Ubin Project, API Exchange, SGFinDex, and Regulatory Sandbox to encourage experimental innovation and development.

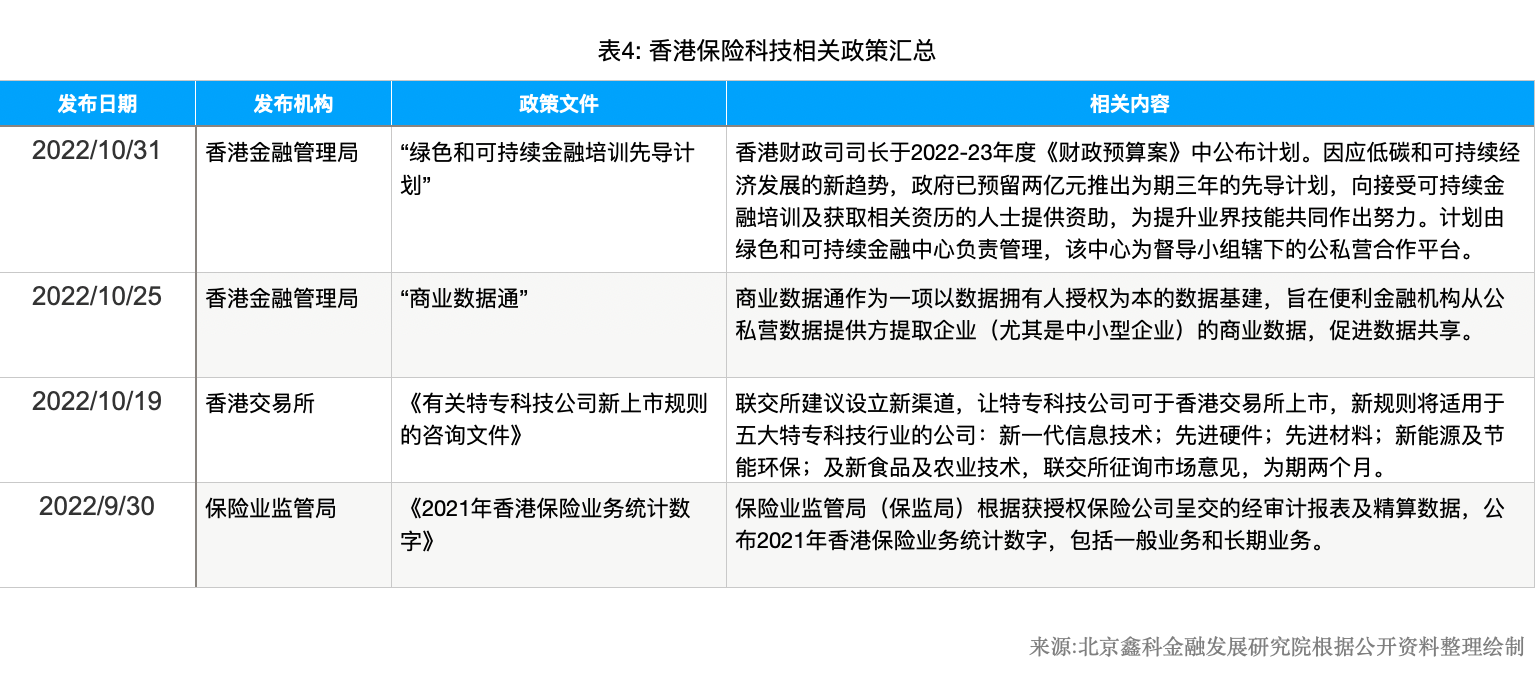

"Hong Kong, China: Innovative Interpretation of Global Financial Hub: Accelerated Development of Insurance Technology in Hong Kong"

Hong Kong's financial technology has been accelerating its development. As one of the world's freest economies, Hong Kong is globally recognized as one of the most suitable places for international banks and insurance companies to establish their headquarters, and also one of the most important financial and insurance centers in the world. The Hong Kong Insurance Regulatory Commission has successively launched pilot projects such as "sandbox supervision" and "fast track" to accelerate the authorization of insurance companies, ultimately promoting the development of insurance technology in Hong Kong. In addition, Hong Kong has established the Future Working Group (FTF). There are three working groups under FTF, and "Embracing Hong Kong Fintech" is one of them, whose task is to promote the application of insurance technology in the insurance industry.

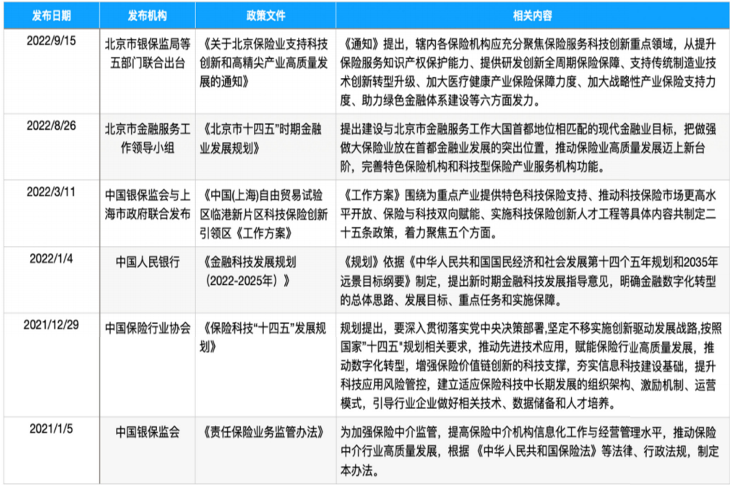

The Chinese market presents a new trend of technological empowerment and healthy growth

During the 14th Five Year Plan period, a series of regulatory policies supporting insurance innovation actively and positively guided and encouraged the insurance industry to actively innovate. From the perspective of overall policy tone, based on the main tone of inclusivity and prudence, the country has consistently promoted the development of insurance technology in China, from "high-speed development" to emphasizing "high-quality development", with consistent policies at the top-level design. From a market perspective, regulatory agencies actively approach the market and form a complete chain of local financial supervision from the "One Bank, Two Sessions" to actively learn advanced overseas insurance technology to promote management experience, better serve innovation in the insurance market, and support and encourage various types of insurance technology innovation. From the perspective of institutional innovation, the People's Bank of China and the China Banking and Insurance Regulatory Commission have piloted the "regulatory sandbox" mechanism to promote financial innovation regulation, and have now entered the stage of normalized solicitation.

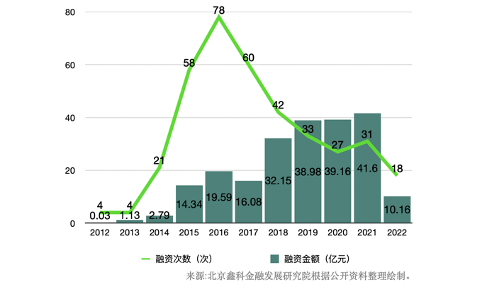

The period from 2015 to 2020 in China's insurance technology can be defined as the five years of capital hot pursuit. This industry is widely recognized, and a group of well-known companies have developed rapidly with the help of capital.v

The challenges and driving factors of the development of insurance technology in China

Technological progress continues to drive the development of insurance technology:

The current core of insurance technology innovation is based on the deep integration of high maturity technology and application scenarios, which will directly promote the emergence of new insurance technology innovation business models. Given the increasing dependence of the insurance industry on complex information technology systems, the insurance industry must be prepared for the high risk of network attacks and system interruptions. In this regard, insurance companies and insurance technology companies must deepen their technical risk management capabilities and be prepared to handle IT security incidents and system failures. On the other hand, the interconnected ecosystem still lacks digital agility. The insurance industry needs a well connected business ecosystem to maintain a fast-paced process. A single platform may connect all participants to interact with each other, thereby improving standards and making the industry more competitive. Given that insurance technology providers rely on digital capabilities to reduce costs, addressing fraud risks is key to the online business model of insurance technology enterprises.

The number of professional composite talents constrains the development of insurance technology:

The insurance industry is dealing with a complex pattern of technological talents. From a global perspective, the core of the labor force transformation in the insurance industry is the comprehensive upgrading of talent strategies triggered by the technology wave. On the other hand, in order for insurance companies to achieve technological innovation, data management, and other key measures, the core is human resource strategy. In other words, talent is the prerequisite for insurance companies to complete a series of "bottleneck" tasks such as process automation and cloud migration. Insurance technology requires high-end composite talents who possess basic insurance professional skills, information technology knowledge, and risk control abilities. However, many job seekers are only proficient in a certain professional field and lack comprehensive abilities. The current insurance industry urgently needs to transform its talent cultivation system, create a suitable institutional environment for talent development, expand the scale of high-income individuals in insurance technology, and establish a more flexible and variable talent introduction and promotion system in order to improve the industry's retention rate.

The empowering demand for comprehensive ecological innovation in the insurance industry:

The purpose of all business is to meet customer needs. By tracking the development process of overseas insurance technology, it has been found that global customers are generally reflected in price discounts, convenience and speed, and information symmetry. The innovation of insurance technology companies is also concentrated in these directions. Cryptocurrency payment methods will continue to surge, and in addition, APIs will help and enrich the insurance technology ecosystem. In the future, the insurance industry will play a greater role from a broader technology ecosystem.

Macro level economic downturn, affecting investor confidence:

Thanks to the explosive development of the Internet in recent years, the scale of insurance funds in China has increased from 6.27 trillion yuan in 2012 to 27.15 trillion yuan in 2022, with an average annual growth rate of 14.3%, making it the second largest insurance market in the world. However, looking at the overall development trend of insurance technology in China, the growth has become increasingly sluggish in the past two years. The investment trend of domestic insurance technology shows a cautious attitude against the backdrop of macroeconomic downturn, which poses more challenges to the insurance technology industry, which already requires a large amount of resources and capital support. At the same time, insurance technology achievements also face the challenge of low maturity. For technology achievements that can be widely applied, preliminary technical experiments, small-scale pilot projects, and commercial applications are required. However, the research and development of insurance technology in China has a relatively short starting time, and most of the technological achievements are still in the experimental and demonstration stage. In order to implement them on a large scale, their maturity level needs to be further accelerated and improved.

The challenges and driving factors of the development of insurance technology in China

Technological progress continues to drive the development of insurance technology:

The current core of insurance technology innovation is based on the deep integration of high maturity technology and application scenarios, which will directly promote the emergence of new insurance technology innovation business models. Given the increasing dependence of the insurance industry on complex information technology systems, the insurance industry must be prepared for the high risk of network attacks and system interruptions. In this regard, insurance companies and insurance technology companies must deepen their technical risk management capabilities and be prepared to handle IT security incidents and system failures. On the other hand, the interconnected ecosystem still lacks digital agility. The insurance industry needs a well connected business ecosystem to maintain a fast-paced process. A single platform may connect all participants to interact with each other, thereby improving standards and making the industry more competitive. Given that insurance technology providers rely on digital capabilities to reduce costs, addressing fraud risks is key to the online business model of insurance technology enterprises.

The number of professional composite talents constrains the development of insurance technology:

The insurance industry is dealing with a complex pattern of technological talents. From a global perspective, the core of the labor force transformation in the insurance industry is the comprehensive upgrading of talent strategies triggered by the technology wave. On the other hand, in order for insurance companies to achieve technological innovation, data management, and other key measures, the core is human resource strategy. In other words, talent is the prerequisite for insurance companies to complete a series of "bottleneck" tasks such as process automation and cloud migration. Insurance technology requires high-end composite talents who possess basic insurance professional skills, information technology knowledge, and risk control abilities. However, many job seekers are only proficient in a certain professional field and lack comprehensive abilities. The current insurance industry urgently needs to transform its talent cultivation system, create a suitable institutional environment for talent development, expand the scale of high-income individuals in insurance technology, and establish a more flexible and variable talent introduction and promotion system in order to improve the industry's retention rate.

The empowering demand for comprehensive ecological innovation in the insurance industry:

The purpose of all business is to meet customer needs. By tracking the development process of overseas insurance technology, it has been found that global customers are generally reflected in price discounts, convenience and speed, and information symmetry. The innovation of insurance technology companies is also concentrated in these directions. Cryptocurrency payment methods will continue to surge, and in addition, APIs will help and enrich the insurance technology ecosystem. In the future, the insurance industry will play a greater role from a broader technology ecosystem.

Macro level economic downturn, affecting investor confidence:

Thanks to the explosive development of the Internet in recent years, the scale of insurance funds in China has increased from 6.27 trillion yuan in 2012 to 27.15 trillion yuan in 2022, with an average annual growth rate of 14.3%, making it the second largest insurance market in the world. However, looking at the overall development trend of insurance technology in China, the growth has become increasingly sluggish in the past two years. The investment trend of domestic insurance technology shows a cautious attitude against the backdrop of macroeconomic downturn, which poses more challenges to the insurance technology industry, which already requires a large amount of resources and capital support. At the same time, insurance technology achievements also face the challenge of low maturity. For technology achievements that can be widely applied, preliminary technical experiments, small-scale pilot projects, and commercial applications are required. However, the research and development of insurance technology in China has a relatively short starting time, and most of the technological achievements are still in the experimental and demonstration stage. In order to implement them on a large scale, their maturity level needs to be further accelerated and improved.