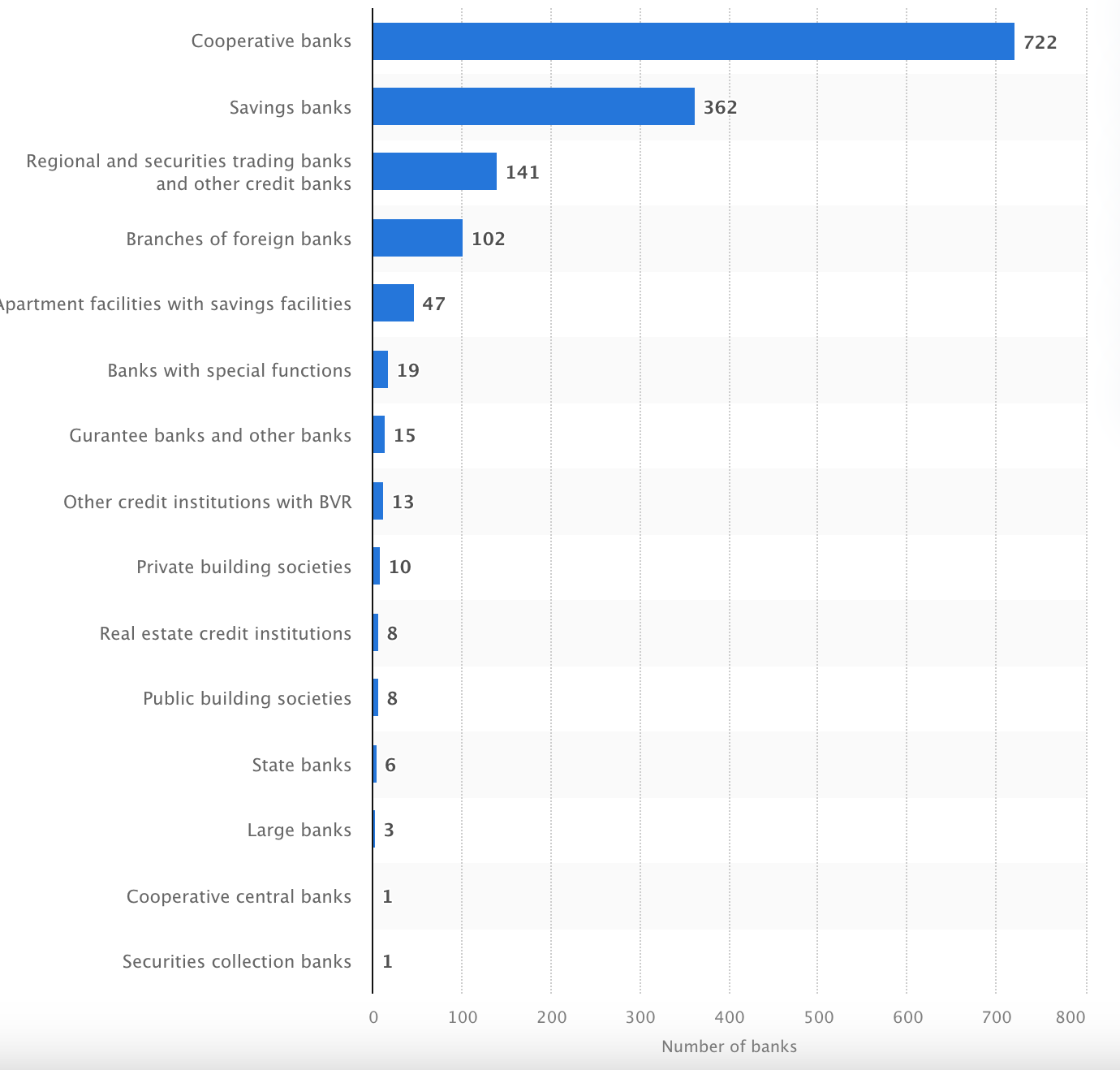

The "Three Pillars" model of German banks

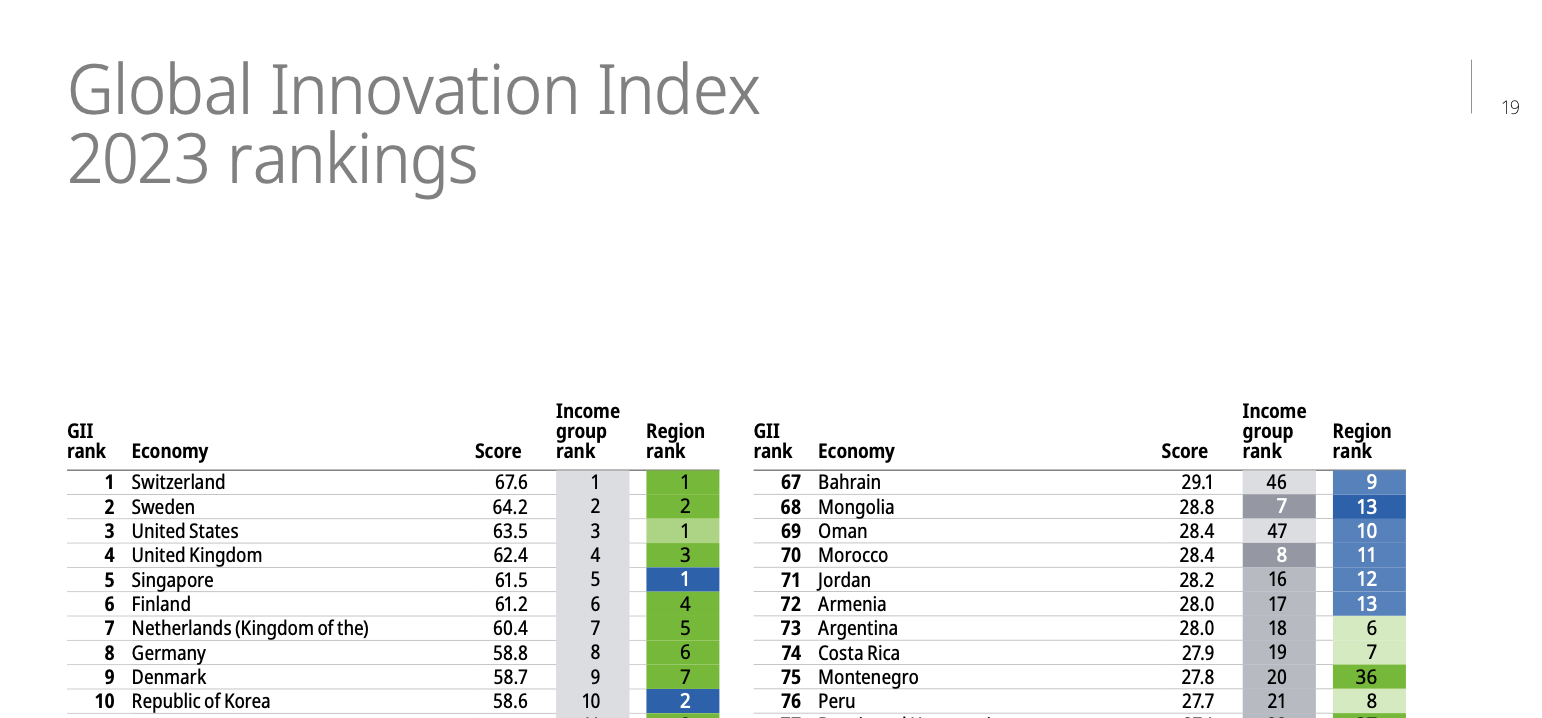

The 2023 Global Innovation Index Report released the top 100 technology clusters globally. Germany has 9 technology clusters on the list, which reflects its strength. Although Germany's population accounts for only 1.1% of the world's total population, its technology cluster accounts for 9% of the world's top 100 technology clusters. This data indicates that Germany's contribution and strength in the field of technology are at a leading level in terms of talent reserves and research investment.

Germany has long focused on technological development, and its unique three pillar banking system - consisting of public savings banks, cooperative banks, and private banks - plays an important role in the financial sector. The diversity of this system not only reflects the characteristics of the German economy, but also plays a crucial role in supporting domestic innovation and technology enterprises. Although the system has received some praise, there are also criticisms, especially in the challenges faced by the banking industry in terms of profits and market integration.

Number of all types of German banks in 2023

Sparkassen is owned by local governments and primarily serves local communities, providing loans and other banking services to small businesses and individuals. The goal of these banks is not to maximize profits, but to support local economic development and social welfare.

Cooperative banks (Volksbank and Raiffeisenbanken) are owned and controlled by members, primarily serving their members, including individuals and small businesses. These banks emphasize community cooperation and mutual assistance among members.

Private banks are owned by private investors, including large commercial banks and investment banks. These banks typically pursue profit maximization and operate globally

The diversity of this three pillar system provides rich returns for the entire economy to a certain extent, although it poses challenges for banking operations. For example, the profitability of the German banking industry has long faced challenges, especially in a low interest rate environment. The average return on equity of banks is lower than the EU average, and the overall cost-income ratio of the industry is also higher than that of other countries. These factors, combined with a dispersed banking system structure, to some extent limit the profitability and growth potential of the German banking industry.

In addition, KfW is the only policy bank in Germany, serving as a catalyst for economic growth, particularly in supporting small and medium-sized enterprises and high-risk technological innovation. KfW utilizes government policy tools to effectively address financing needs that the market cannot fully meet by providing various financial services such as low interest loans, guarantees, equity investments, and subsidies. Its cooperation with commercial banks is based on complementarity rather than competition, with a focus on promoting sustainable development and social responsibility, rather than just pursuing profit maximization. This model reflects the special position and role of policy banks in the modern economic system.

Characteristics of German banking model

Diversified banking system: Germany's three pillar banking system provides diversified financing channels for technology enterprises. Public savings banks and cooperative banks are more focused on serving communities and small and medium-sized enterprises, providing necessary support for local innovative small businesses. Private banks and commercial banks can provide larger scale financing to help technology companies expand and internationalize.

Support for small and medium-sized enterprises: The German economy is dominated by small and medium-sized enterprises, and the banking system places special emphasis on small and medium-sized enterprises in the technology sector, which is crucial for cultivating and developing high paying technology industries.

Robust regulatory framework: The German banking industry has a strict and robust regulatory system, which maintains the stability and sustainability of the financial market and provides a reliable financing environment for technology enterprises.

The principle of limited profit: The German banking system adheres to a "limited profit" orientation, which enhances the stability of the system. Since World War II until the 2008 financial crisis, Germany has not experienced a major banking crisis, which is relatively rare in industrialized countries.

Low profitability: Compared to international standards, the profitability of German banks is relatively low, mainly due to the fact that public savings banks and credit cooperatives do not pursue profit maximization.

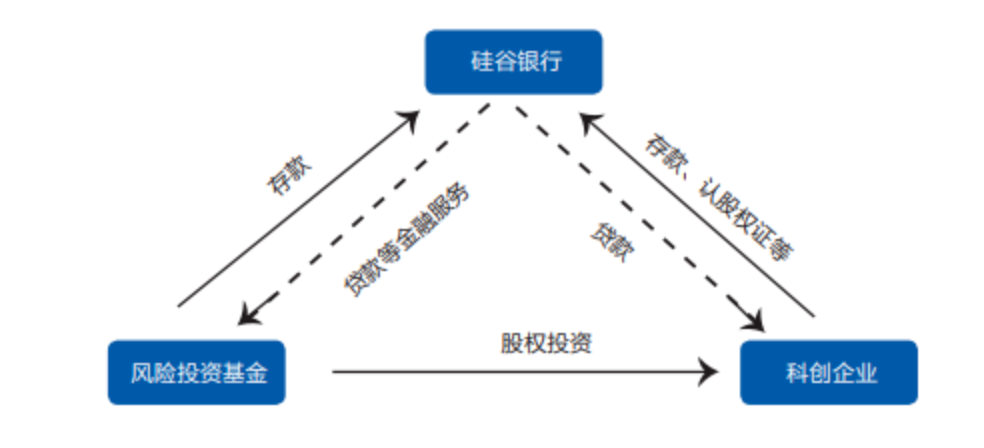

Silicon Valley Bank Investment Loan Linkage Business Model in the United States

The US government has always focused on the development of small and medium-sized technology enterprises, and the Biden Harris administration's 2023 fiscal year budget has made historic investments in science and technology. The budget provided $111 billion for basic and applied research, an increase of $25 billion (29%) from the 2021 fiscal year, and exceeded $100 billion for the first time. In addition, overall R&D expenditure was $205 billion, an increase of $45 billion (28%) from the 2021 fiscal year, and also exceeded $200 billion for the first time.

On March 10, 2023, Silicon Valley Bank in the United States was taken over by the Federal Deposit Insurance Corporation (FDIC) due to financial constraints and insolvency, becoming the second largest bank failure in the United States since the 2008 subprime crisis, shaking global financial markets. As the 16th largest bank in the United States, Silicon Valley Bank has long been focused on serving small and medium-sized technology enterprises and is regarded as a model for banks to support technological innovation. Despite its bankruptcy causing concern, Silicon Valley Bank's business model and support for technology startups are still worthy of recognition.

The "investment loan linkage" business model of Silicon Valley Bank is an innovative financial service designed specifically for startups and high growth technology companies. This model combines two financial instruments, loans and equity investments, aimed at supporting these enterprises in critical growth stages.

Image source: Tsinghua Financial Review

In this model, Silicon Valley Bank not only provides loans as creditors to help companies meet short-term funding needs and operating costs, but also participates as investors in the long-term equity structure of the company through warrants or direct investments. This arrangement allows banks and enterprises to share their growth achievements, while providing them with a certain degree of risk protection through shareholding.

For technology startups, the advantage of this model is that they can obtain the necessary funds to extend operating hours, advance product development, or expand market share without immediately giving up a significant amount of equity in the company. This provides a financing approach for enterprises to avoid premature dilution of equity, while also reducing the risk of operational interruption due to funding shortages.

For Silicon Valley banks, this model allows them to participate in the growth of high potential enterprises, while also obtaining returns through loan interest and possible equity appreciation. However, banks also have to bear higher risks, as startups often do not have enough assets as collateral and their cash flow may be unstable.

The key to the success of the "investment loan linkage" business model lies in accurate risk assessment and selecting the right partners. Silicon Valley Bank must evaluate the development potential of the enterprise, the ability of the management team, the market competition environment, and the sustainability of the business model.

The Future Path of China's Banking Industry

Enhance financial product innovation: China's banking industry should further promote financial product innovation, especially targeting the needs of technology enterprises. For example, developing financial products specifically for early-stage technology startups, such as venture capital loans, equity investments, and flexible credit products. Introduce more customized financing solutions based on the growth stage of technology enterprises, such as loan support in the research and development stage and capital injection in the market expansion stage.

Optimizing the credit evaluation system: Traditional credit evaluation systems are often not suitable for high-risk technology enterprises. Therefore, banks need to develop more accurate and flexible credit evaluation models, taking into account the unique characteristics of technology enterprises, such as innovation capabilities, research and development potential, and market growth prospects. At the same time, banks should reduce their reliance on collateral and traditional financial statements, and focus more on the future revenue potential and technological innovation capabilities of enterprises.

Strengthening cooperation with technology enterprises: Banks should proactively establish closer cooperative relationships with technology enterprises, understand their specific needs and challenges, and provide them with tailored financial services and consulting. This includes establishing partnerships with innovation incubators, science parks, and university research institutions to jointly promote technological innovation and commercialization.

Combining traditional and innovative science and technology innovation services: On the basis of maintaining the robust advantages of traditional commercial banking models, we introduce a Silicon Valley style banking service model to better serve technology innovation enterprises. Especially through the implementation of investment loan linkage financing models, this strategy is particularly suitable for high-risk technology enterprises. This model combines loans and equity investments, allowing banks to share the benefits of corporate growth while taking on moderate risks. This not only requires banks to innovate in risk management and capital allocation to adapt to the unique characteristics of technology enterprises, but also requires them to adjust their service methods to meet the specific needs of these enterprises.

Maintaining a differentiated financial institution system: China's banking industry is also a multi-level system, including national banks such as state-owned banks and joint-stock banks, regional banks such as urban commercial banks, rural commercial banks, and village banks, as well as professional banks. In this system, banks should shift their focus from simply pursuing scale expansion to focusing on improving service quality and efficiency for the real economy, especially for technology innovation enterprises.

epilogue

In this rapidly changing era, financial technology has emerged as a key force driving social progress and economic growth. Faced with such a development trend, the traditional banking business model is at a critical moment of transformation. The banking industry needs to abandon outdated financial service methods and adopt more flexible and innovative business strategies, actively integrating into the wave of digitization and intelligence to cope with the continuous changes in market demand and the rapid development of technology. Close cooperation and mutual support with technology enterprises have become the core driving force for promoting economic structural transformation and improving development levels. This cooperation model not only provides necessary financial assistance and professional consulting to technology enterprises, but also enables the banking industry to have a deeper understanding and adapt to the rapid development of the technology industry, providing strong support for China's future financial construction.

Authors: Gan Yutao, Chu Xianghe, Yu Yue