They are:

1. Popularize Generative Artificial Intelligence

2. Artificial intelligence trust, risk, and security management

3. Artificial intelligence enhancement development

4. Intelligent applications

5. Enhance the Internet workforce

6. Machine Customers

7. Continuous threat exposure management

8. Sustainable Technology

9. Platform Engineering

10. Industry cloud platforms

Each trend is associated with at least one core business theme, including protecting current and future investments, providing appropriate solutions to appropriate stakeholders at the right time, and adapting to the constantly changing environment of internal and external customers, providing effective value.

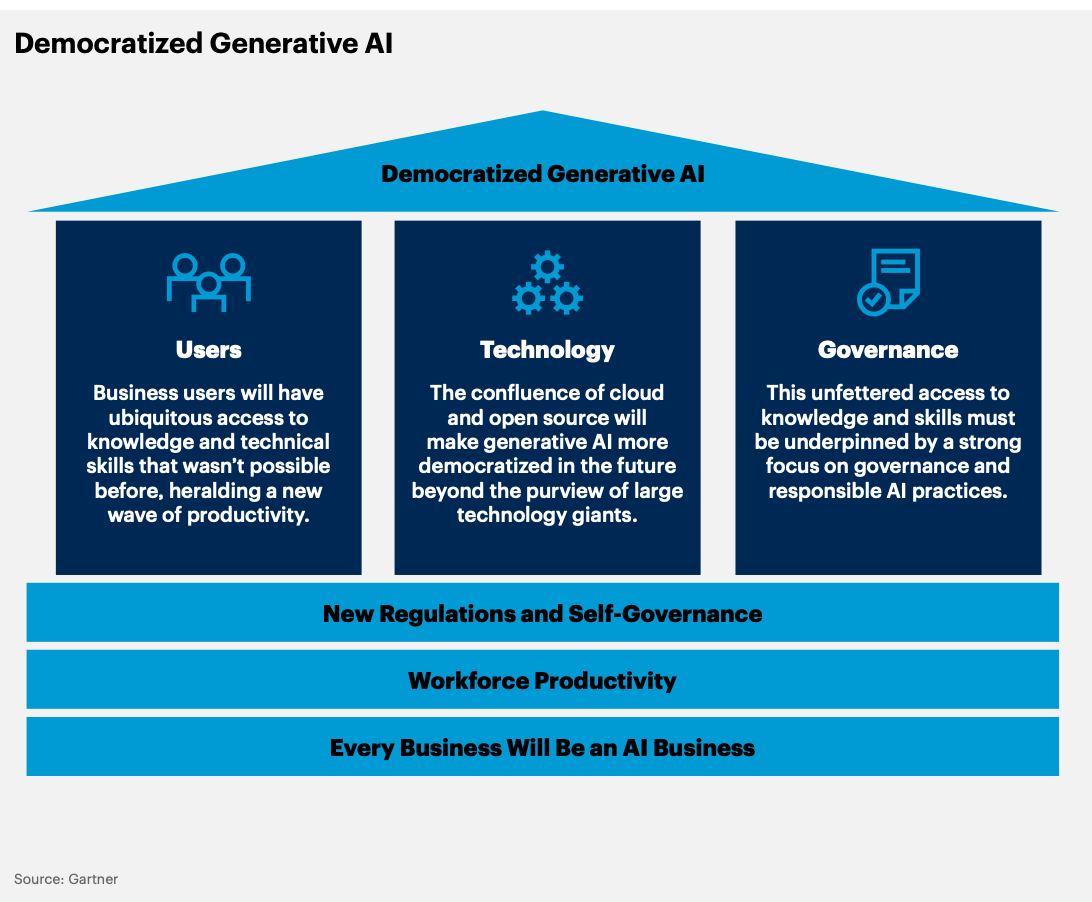

1. Popularize Generative Artificial Intelligence

The popularization of generative artificial intelligence democratizes technology by integrating large-scale pre training models, cloud computing, and open source through various data. It has become one of the most disruptive technologies in the past decade to enable workers without professional technical background to create text, video, code, images, audio and other content through text Q&A.

Gartner predicts that by 2026, over 80% of businesses will use generative AI APIs/models and applications that support generative AI in production environments, compared to less than 5% in 2023.

Why has it become a major technological trend?

Popularizing the use of generative artificial intelligence throughout the organization has the potential to automate a wide range of tasks, improve productivity, reduce costs, and provide new growth opportunities. It has the ability to transform the way almost all businesses compete and work. The democratization of information and skills will be achieved across a wide range of roles and business functions.

A large amount of internal and external information resources can be easily accessed and used by business users through natural language conversation interfaces.

Golden Hair Institute Observation:

The popularization of generative artificial intelligence may lead to significant changes in business models and service methods. It can improve efficiency and reduce labor costs by automating and optimizing the daily tasks of financial services. The application of generative AI may also extend to the development of personalized financial products and services, providing a more customized customer experience. In addition, the application of this technology in risk management and fraud detection can significantly improve the ability of financial institutions to process complex data and predict future trends, thereby enhancing decision quality and security. Overall, the popularization of generative artificial intelligence will drive the fintech industry towards greater intelligence, efficiency, and customer friendliness.

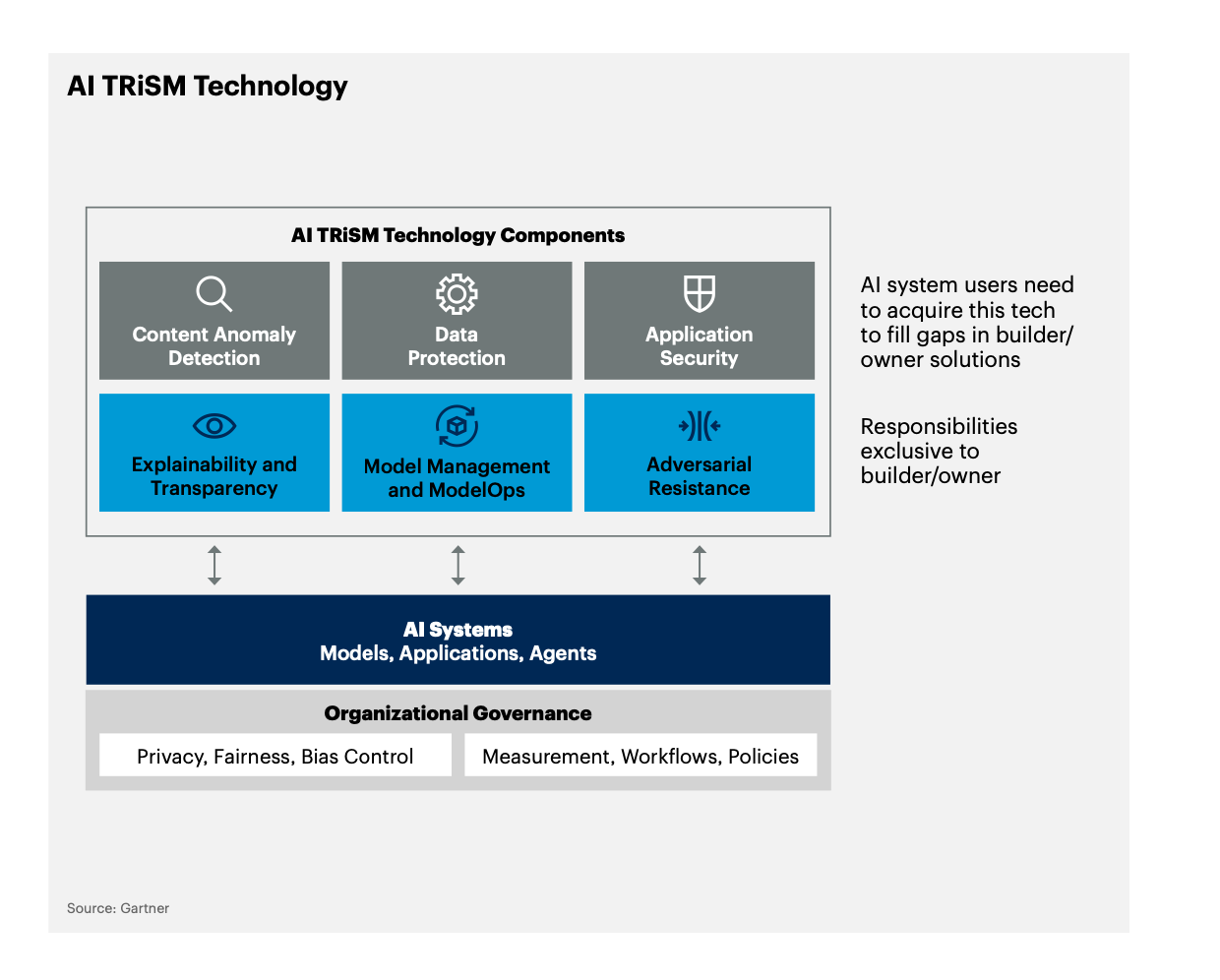

2. Artificial intelligence trust, risk, and security management

The popularization of AI has made the demand for trust, risk, and security management (TRiSM) in AI more urgent and clear. In the absence of guardrails, AI models may quickly generate multiple negative effects out of control, offsetting all positive performance and social benefits brought by AI. AI TRiSM provides tools for Model Ops, active data protection, AI specific security, model monitoring (including monitoring of data drift, model drift, and/or unexpected results), as well as third-party model and application input and output risk control.

Gartner predicts that by 2026, companies adopting AI TRiSM control measures will improve decision-making accuracy by screening out up to 80% of erroneous and illegal information.

Golden Hair Institute Observation:

Financial technology relies on the accuracy and security of data, so the introduction of TRiSM can enhance the reliability and trust of these systems. By implementing Model Ops, proactive data protection, and AI specific security measures, financial institutions can more effectively manage and monitor AI models, preventing data drift, model drift, and unexpected results. This not only improves the security and stability of financial products and services, but also enhances customer trust in financial institutions using AI. This management approach also helps financial institutions comply with increasingly strict regulatory requirements, thereby promoting the healthy and sustainable development of the fintech industry.

3. Artificial intelligence enhancement development

AI enhanced development refers to the use of AI technologies such as generative AI and machine learning to assist software engineers in application design, coding, and testing. AI assisted software engineering improves the productivity of developers, enabling development teams to meet the growing demand for software in business operations. These AI integrated development tools can reduce the time software engineers spend writing code, giving them more time to carry out more strategic activities, such as designing and assembling attractive business applications.

Gartner predicts that by 2028, 75% of enterprise software engineers will use artificial intelligence programming assistants, compared to less than 10% in early 2023.

Golden Hair Institute Observation:

This technology can accelerate the design and implementation of financial products and services, promoting the development of innovation. It improves software development efficiency and reduces human errors by automating coding and testing processes. Meanwhile, AI can help develop more precise and personalized financial solutions to meet the diverse needs of customers. The ability of AI in data analysis and processing will enable fintech companies to more effectively identify market trends and customer behavior, thereby providing more competitive financial products.

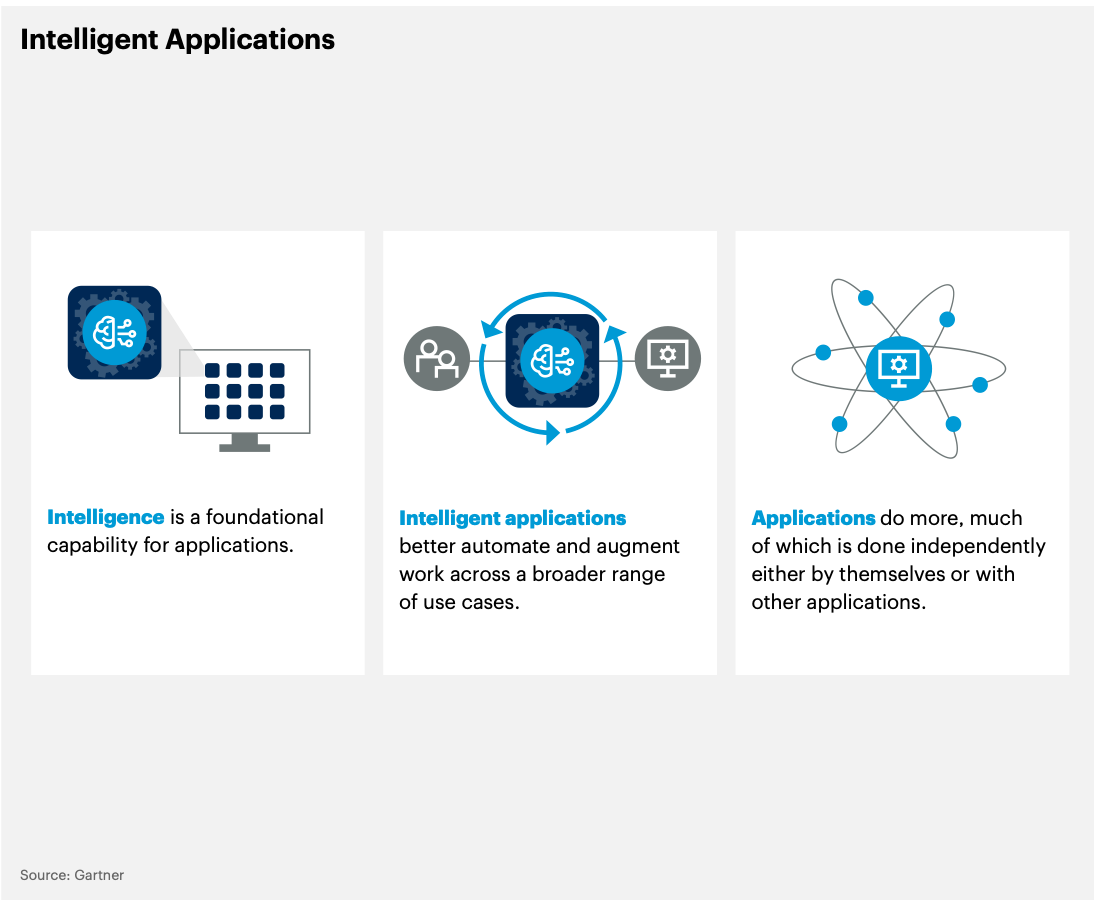

4. Intelligent applications

Gartner defines "intelligence" in intelligent applications as the learned adaptive ability to autonomously make appropriate responses. In many use cases, this intelligence is used to better enhance work or increase the level of automation of work. As a fundamental capability, intelligence in applications includes various AI based services such as machine learning, vector storage, and connecting data. Therefore, intelligent applications can provide a constantly adapting user experience.

The application of generative artificial intelligence can greatly enhance the intelligence level of applications, thereby changing the experience of customers, users, product owners, architects, and developers. It integrates transactions and external data, directly integrating profound insights into commonly used applications by business users, avoiding reliance on independent business intelligence tools. The added predictive or recommendation capabilities of artificial intelligence in applications, rather than purely procedural features, make applications more customized, improve user outcomes, and promote data-driven decision-making.

Golden Hair Institute Observation:

The application of intelligent applications in the fintech industry heralds a revolution. These applications can provide highly personalized customer experiences and more accurate risk assessments through integrated AI services such as machine learning and data analysis, thereby improving service efficiency and decision quality. Intelligent applications can also promote the automation of financial products and services, reducing operational costs.

5. Enhance the Internet workforce

A strategy to enhance the interconnected workforce by establishing connections with organizations and optimizing the value provided by human resources employees. This strategy accelerates and expands talent development by utilizing intelligent technology, labor analysis, and skill enhancement. By the end of 2027, 25% of Chief Information Officers (CIOs) will use the Enhanced Connected Workforce Program to reduce the lead time for key positions by 50%.

Golden Hair Institute Observation

The combination of intelligent technology, labor analysis, and skill enhancement in enhancing the workforce of interconnected employees will improve their efficiency and productivity, enabling them to better adapt to the rapidly changing financial market. Financial institutions can utilize this enhanced work model to provide more precise and personalized customer service, while accelerating innovation and market promotion of financial products.

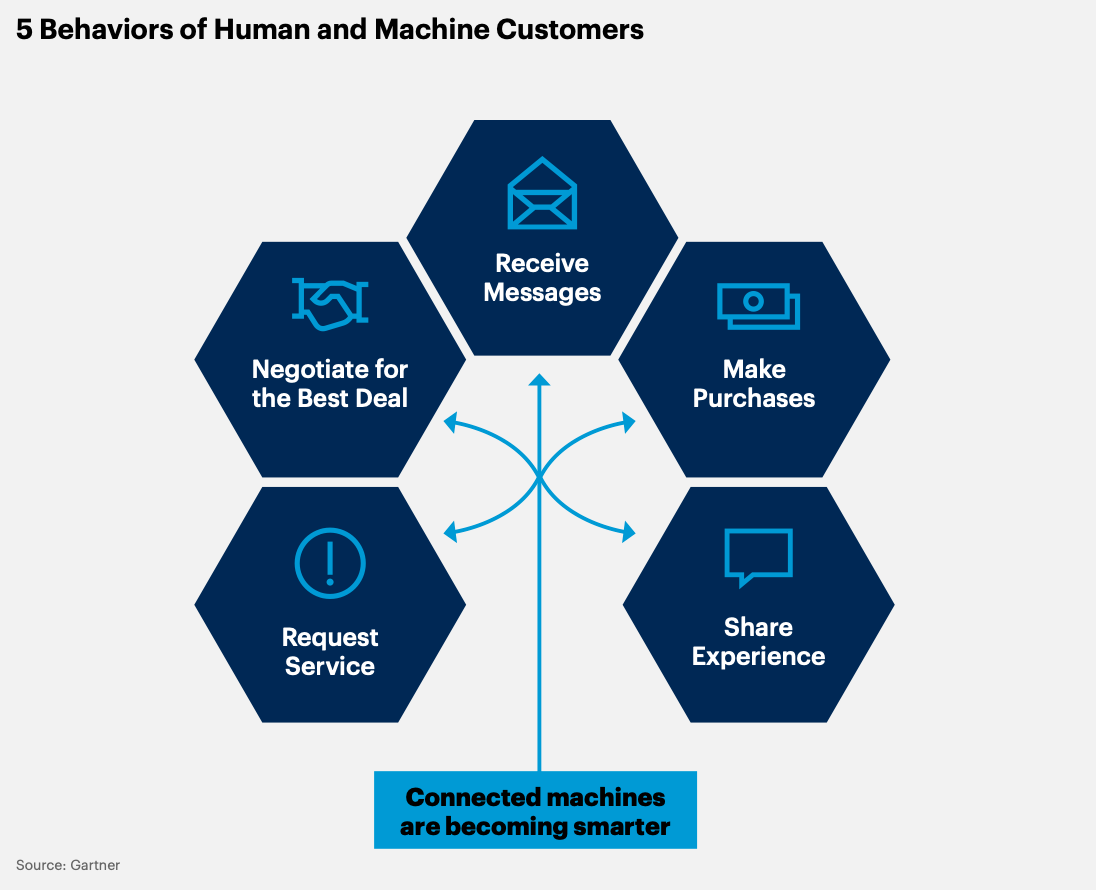

6. Machine Customers

Machine customers (also known as "customer robots") are non-human economic entities that can autonomously negotiate and purchase goods and services in exchange for rewards. By 2028, there will be 15 billion connected products with the potential to become customers, and this number will increase by billions in the coming years. By 2030, this growth trend will bring in trillions of dollars in revenue, and its importance will eventually surpass the emergence of digital commerce. Strategically, consideration should be given to providing convenience and even creating opportunities for new customer robots for these algorithms and devices.

Golden Hair Institute Observation:

With the rise of machine clients, financial services and products will need to adapt to the unique needs of non-human entities, which may include providing services for algorithm driven trading systems, automated investment advisors, or other AI systems. This transformation will not only drive innovation in fintech products and services, but also lead financial institutions to explore new business models, such as customized investment strategies, risk management solutions, and payment systems for machine clients.

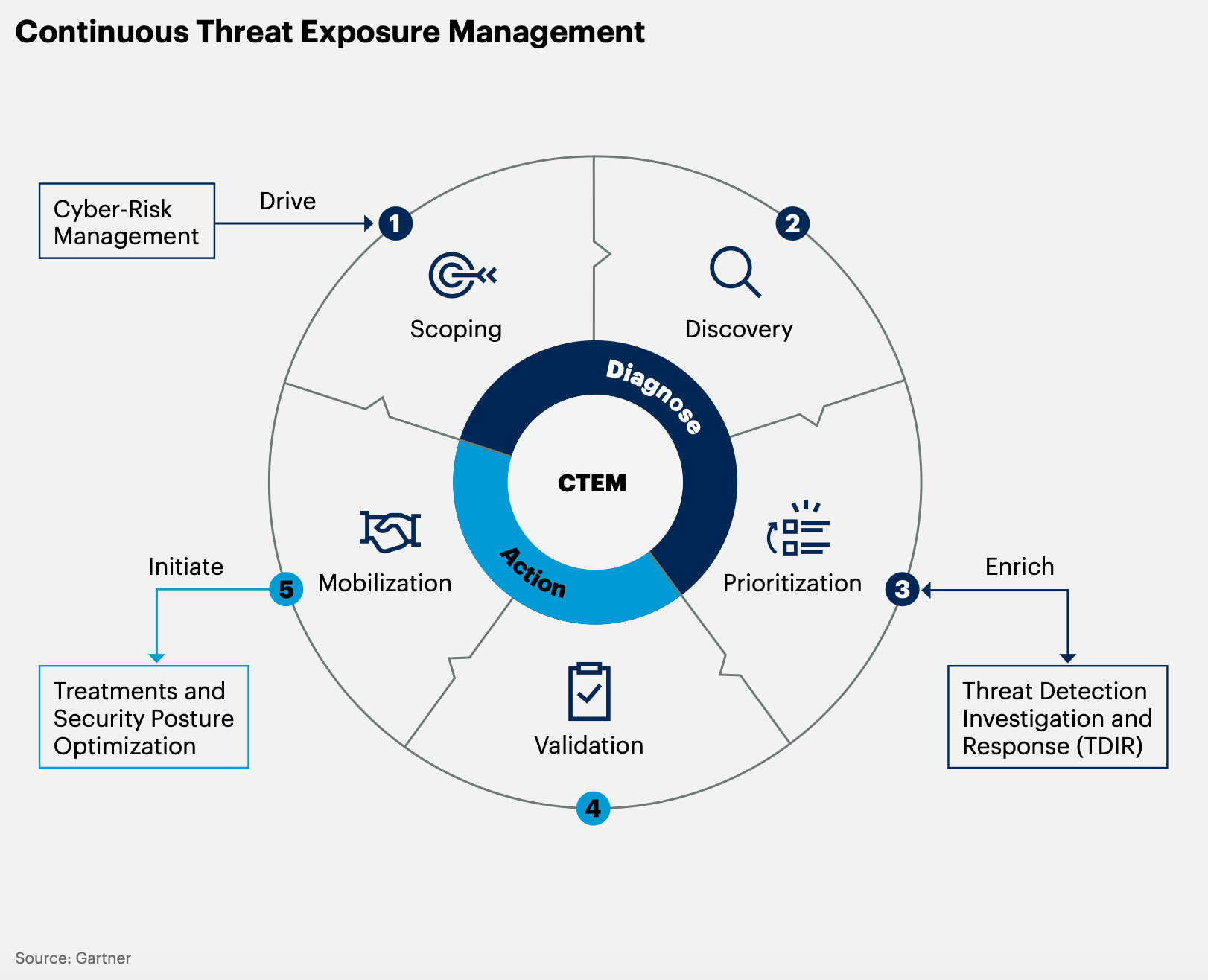

7. Continuous threat exposure management

Continuous Threat Exposure Management (CTEM) is a pragmatic and systematic approach that enables business organizations to continuously and uniformly evaluate the accessibility, exposure, and availability of digital and physical assets in a company. Adjusting the scope of CTEM assessment and repair based on threat carriers or business projects (rather than infrastructure components) can not only identify vulnerabilities, but also identify threats that cannot be repaired.

Golden Hair Institute Observation:

Financial institutions are facing increasingly complex and changing cybersecurity threats, and CTEM provides a mechanism for continuous monitoring and response to these threats. By analyzing and evaluating security vulnerabilities in real-time, financial institutions can more effectively prevent and mitigate potential network attacks, protect critical data and assets. This not only enhances customer trust and satisfaction, but also helps financial institutions comply with increasingly strict regulatory requirements.

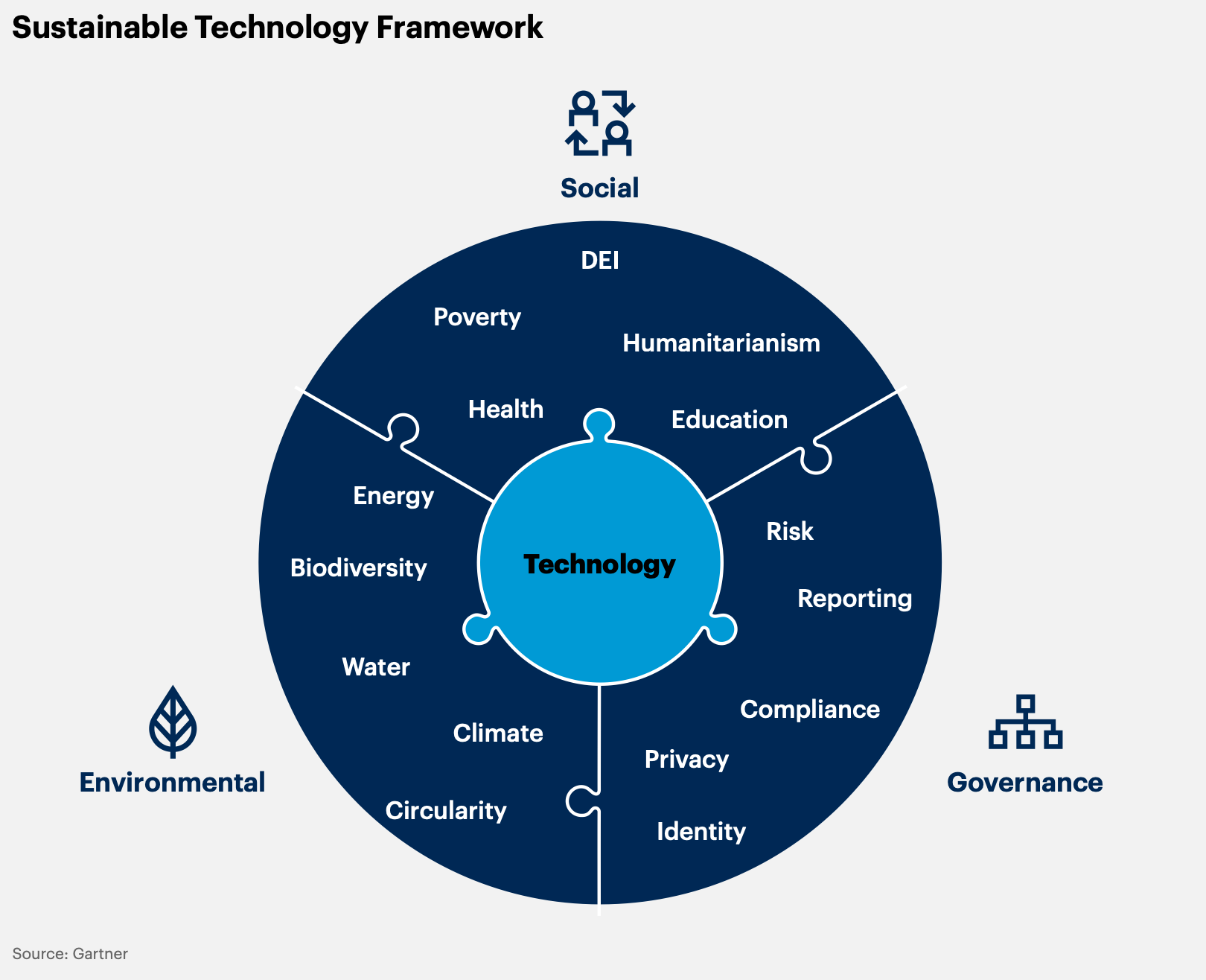

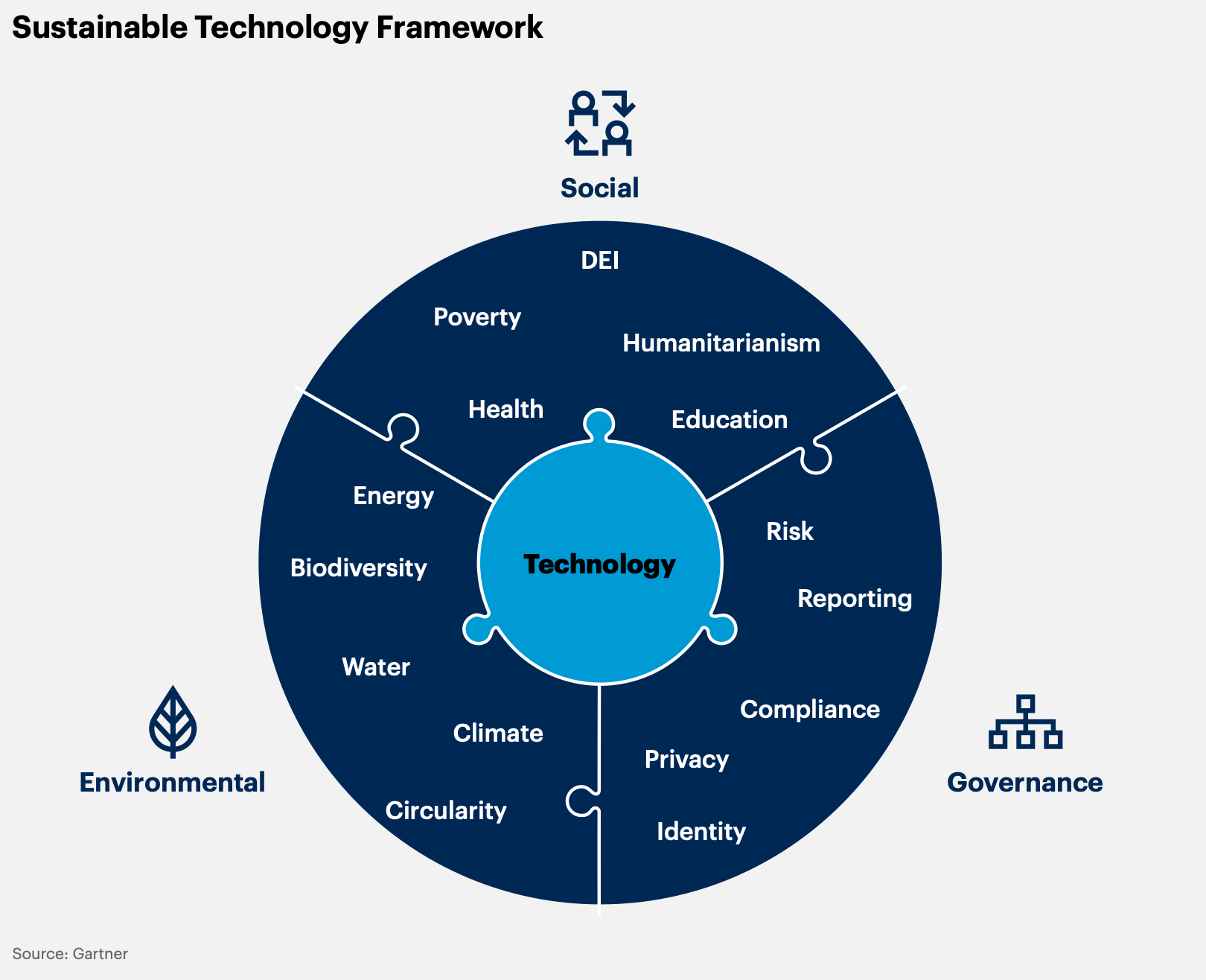

8. Sustainable Technology

Sustainable technology is a digital solution framework used to achieve environmental, social, and governance (ESG) outcomes, supporting long-term ecological balance and human rights. The use of technologies such as AI, cryptocurrency, the Internet of Things, and cloud computing is raising concerns about energy consumption and environmental impacts. Therefore, improving efficiency, recyclability, and sustainability when using IT has become even more important. In fact, Gartner predicts that by 2027, 25% of CIO's personal compensation will be linked to their impact on sustainable technology.

Golden Hair Institute Observation:

By adopting sustainable technologies, enterprises can more effectively monitor and manage their impact on the environment, promote social responsibility, and improve governance transparency. This not only helps companies achieve long-term ecological balance and uphold human rights, but also enhances their market competitiveness and brand image, attracting more sustainable investors and consumers.

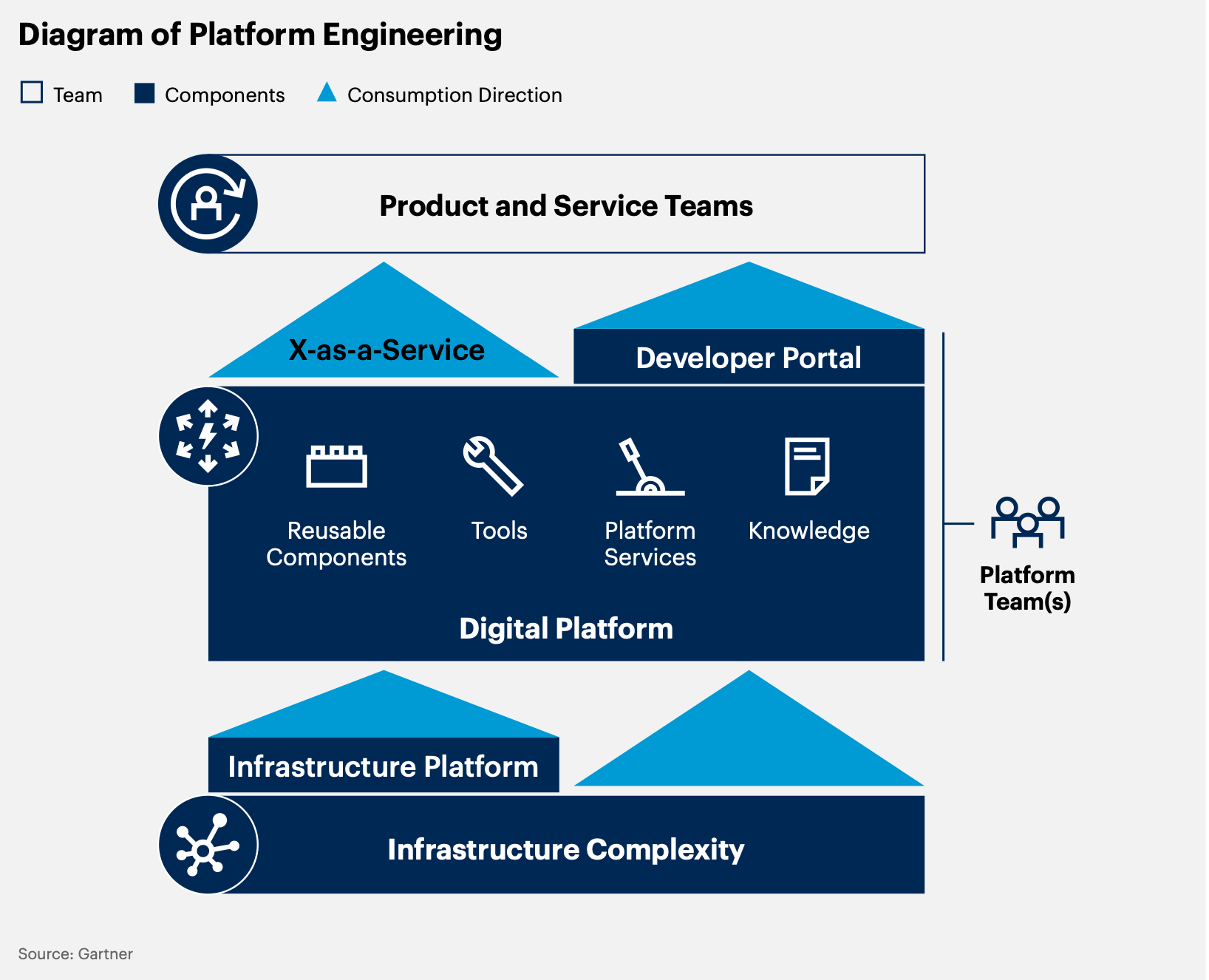

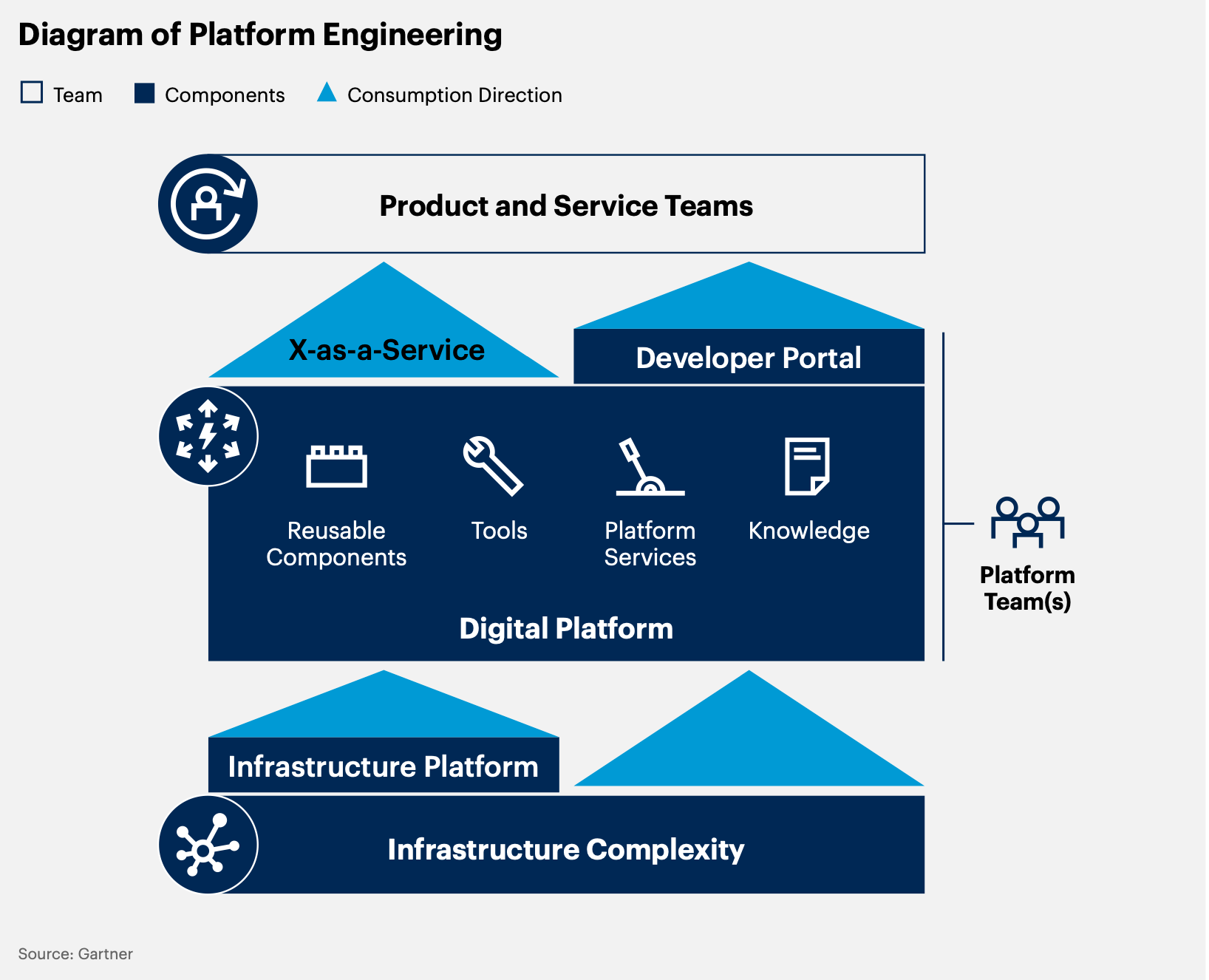

9. Platform Engineering

Platform engineering is a discipline for building and operating self-service internal development platforms. Each platform is a layer created and maintained by a dedicated product team to support user needs through integration with tools and processes. The goal of platform engineering is to optimize productivity and user experience, and accelerate the realization of business value.

Golden Hair Institute Observation:

By establishing a dedicated internal platform, financial institutions can more effectively integrate and manage their services and operations. These self-service platforms not only improve operational efficiency, but also promote innovation and collaboration, making the development and deployment of financial products more flexible and rapid.

10. Industry cloud platforms

By combining the underlying software as a service (SaaS), platform as a service (PaaS), and infrastructure as a service (IaaS) into a complete product offering, it has the ability to combine and solve industry related business outcomes. Gartner predicts that by 2027, over 70% of enterprises will use industry cloud platforms (ICPs) to accelerate their business plans, while this proportion is less than 15% in 2023. ICP integrates underlying SaaS, PaaS, and IaaS services into a complete set of products through composable features, driving industry related business outcomes. These features typically include industry data weaving, packaging business function libraries, combination tools, and other platform innovation features. ICP is a cloud solution tailored for specific industries, which can further meet the needs of enterprise institutions.

Golden Hair Institute Observation:

Financial institutions are facing increasingly complex and changing cybersecurity threats, and CTEM provides a mechanism for continuous monitoring and response to these threats. By analyzing and evaluating security vulnerabilities in real-time, financial institutions can more effectively prevent and mitigate potential network attacks, protect critical data and assets. This not only enhances customer trust and satisfaction, but also helps financial institutions comply with increasingly strict regulatory requirements.

Click on the link to view the full text: https://emt.gartnerweb.com/ngw/globalassets/en/publications/documents/2024-gartner-top-strategic-technology-trends-ebook.pdf?_gl=1 *1r3j5a0*_ Ga * NjMyNDMxNjkyLjE3MDE3Mzg0MDc*_ GA_ R1W5CE5FEV * MTcwMTczODQwNy4xLjEuMTcwMTczODQ2MC43LjAuMA

Deepen the application of scenarios and "chains" to connect a better future

Deepen the application of scenarios and "chains" to connect a better future