With the development of the global economy and the increasing complexity of international financial markets, wealth management has become an important and evolving field. Especially in international financial centers like Luxembourg and Singapore, wealth management business not only shows strong growth momentum, but is also adapting to changes in global wealth distribution and investment preferences by adopting new policies and strategies.

Luxembourg, as one of the major financial centers in Europe, has a superior geographical location and mature regulatory environment, making it an ideal location for wealth management. Singapore, as one of the leading private banking and wealth management centers in Asia and globally, is renowned for its sound financial regulation, strong rule of law system, and political and economic stability. This article aims to explore the new policies recently adopted by Luxembourg and Singapore in the field of wealth management, analyze the characteristics and impacts of these policies, and explore their possible implications for the Chinese wealth management market.

Luxembourg's New Wealth Management Policy

The new government established after the parliamentary elections held on October 8, 2023, announced its agenda for the next five years in the Joint Governance Agreement ("Joint Agreement") signed on November 16, 2023. The joint agreement confirms the government's willingness to maintain stable public spending and maintain Luxembourg's AAA rating in the future, which is a sign of its fiscal stability and a guarantee of its economic attractiveness. These changes mainly focus on the following key areas:

Comprehensive reduction of tax burden: Starting from 2024, personal income tax will be reduced to increase household purchasing power, especially for small and medium-sized income groups and specific tax category individuals (such as single parent families and those aged 65 and above). The adjustment of corporate income tax and municipal business tax rates aims to strengthen the competitiveness of the economic and financial sectors, especially by supporting innovative companies investing in digital and sustainable transformation through tax incentives. In addition, the government plans to enhance the competitiveness of Luxembourg's financial center through simplified tax laws and digital reforms, while supporting the development of sustainable financial products.

These tax policies are of great significance for the wealth management industry. Lowering personal income tax can increase the disposable income of potential customers, which may increase the demand for wealth management services. Adjusting corporate tax rates may attract more wealth management related companies to establish or expand businesses in Luxembourg, thereby enhancing Luxembourg's position as a global wealth management center. For tax incentives for investing in innovation, wealth management institutions and their clients can be encouraged to explore new investment opportunities, especially in the areas of digitalization and sustainable development, which are crucial for the long-term growth and diversification of the industry.

Digital Transformation: The new government of Luxembourg is committed to cultivating a resilient, diversified, and innovative economy to address the challenges and opportunities brought about by digital and green transformation. To this end, the government plans to develop a national digital strategy for all ministries, administrative agencies, and municipal authorities, analyze needs, and develop a development roadmap for each stakeholder. At the same time, the agreement also includes simplifying administrative procedures for small and medium-sized enterprises, applying the "ThinkSmall First" principle, developing one-stop services for enterprises, digitizing the national subsidy process for small and medium-sized enterprises, and creating data-driven service products for small and medium-sized enterprises based on the latest proposals at the EU level.

From the perspective of wealth management, these measures help create a more favorable business environment, especially for small and medium-sized enterprises, which may bring new customers and investment opportunities to the wealth management industry. In addition, the focus of digitalization and green transformation has also provided new investment areas for wealth management, especially in sustainable financial products and services.

New Trends in Wealth Management in Singapore

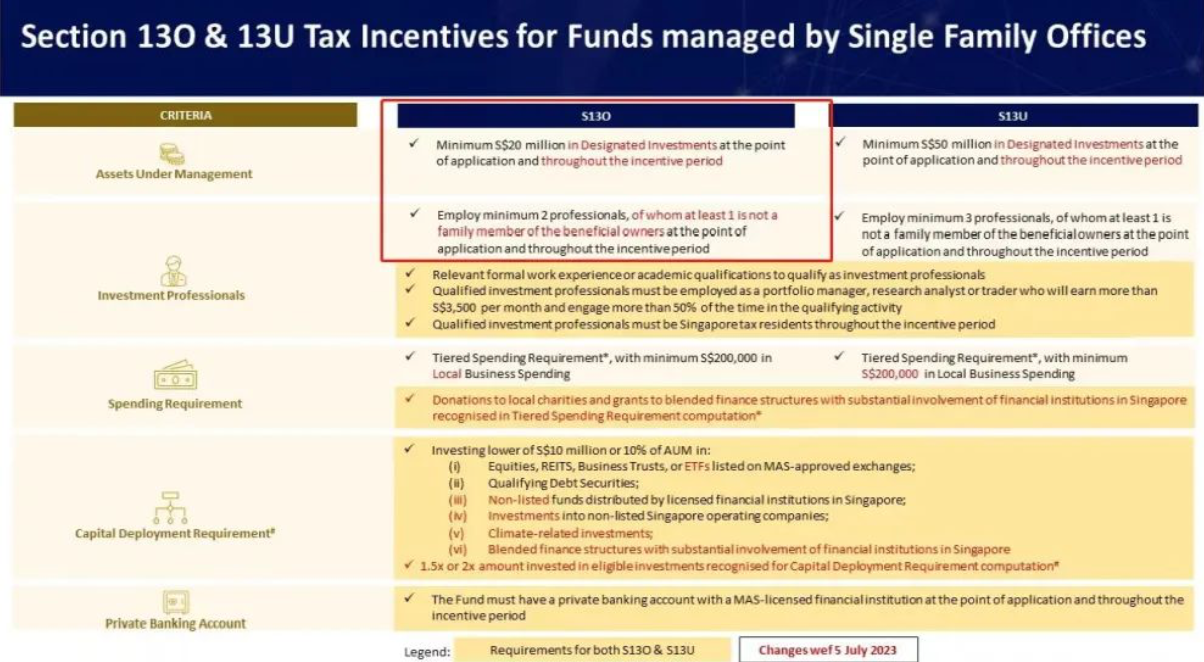

In order to promote purposeful contributions, the Monetary Authority of Singapore announced on July 5, 2023 improvements to the tax incentive plan for single family offices. The updates are mainly made in four aspects: "scale of funds for home run enterprises", "requirements for professional investment members", "operating expenses for home run enterprises", and "local investment requirements".

Increased funding requirements: The new policy raises the funding threshold for family offices to 20 million Singapore dollars. This means that the family office must demonstrate stronger financial strength in order to enjoy tax benefits. This change may lead to some smaller family offices seeking more funding or reassessing their business strategies in Singapore.

Strict requirements for professional investment members: The new regulations require family offices to hire at least two professional investment personnel, improving operational professionalism and the quality of investment strategies. This may make the family office more challenging in talent recruitment, but it also promotes the improvement of its management and investment capabilities.

New regulations on operating expenses: According to the size of assets, family offices must meet certain minimum operating expenses requirements. This emphasizes activities and investments in the local market. For family offices with larger assets, this may mean investing more resources to meet these requirements and further strengthening their participation in the Singapore market.

Update on local investment requirements: Strengthen investment in locally recognized financial products and institutions, and promote local investment through investment multiplier mechanisms. This change encourages family offices to participate more in the local market, which may have a positive stimulating effect on Singapore's financial market and related industries.

Inspiration for China

Focus on the wealth trends and immigration tendencies of high net worth individuals:

It is crucial to pay attention to the wealth trends and immigration tendencies of China's high net worth population. According to the latest report by Henley&Partners, in 2023, China became the country with the highest output of high net worth immigrants worldwide, with a total outflow of 13500 high net worth individuals. This reflects a sustained trend of wealth outflow.

The investment and immigration activities of high net worth individuals are key channels for wealth to flow to wealth management centers. When considering the family offices and investment immigration policies of various wealth management centers, special attention should be paid to individuals with family assets of over 500 million yuan and high entrepreneurial qualities. In response to this trend, China should further enrich its domestic investment targets and improve the convenience of cross-border asset allocation. At the same time, on the basis of the return of trust to its original business, we will vigorously develop family trusts, charitable trusts, etc., in order to improve the sustained growth and inheritance expectations of the wealth of China's high net worth population. These measures help to reduce their willingness to invest and immigrate overseas, thereby creating a wealth management system with Chinese characteristics.

Strengthening the cultivation of wealth management professionals:

The wealth management market in China is currently in a stage of rapid growth, demonstrating enormous development potential and market opportunities. According to China Merchants Bank's "2023 China Private Wealth Report", by 2022, China's individual investable assets will reach 278 trillion yuan, of which the assets of high net worth individuals will reach 101 trillion yuan. These numbers reflect the huge scale and growth potential of China's wealth management market. The vast market reflects a lack of professionals.

Wealth managers need to have extensive financial knowledge, including a deep understanding of various investment products such as stocks, bonds, funds, futures, as well as professional knowledge in tax, legal, insurance, and other fields. In addition to theoretical knowledge, they also need rich practical experience, including a deep understanding of customer needs and risk tolerance, to provide personalized wealth management solutions. At the same time, it has a keen insight into the financial market and macroeconomic situation, in order to adjust investment strategies in a timely manner in response to market changes, and ensure the safety and stable appreciation of customer assets.

Therefore, China should learn from the experiences of Singapore and Luxembourg, strengthen the training and education of wealth management talents, especially in professional ethics and compliance knowledge, and encourage the cultivation of talents with an international perspective. In addition, it is encouraged to carry out training for registered wealth managers to enhance the professional level of the industry and meet the market's demand for high-quality wealth management talents.

Innovative wealth management products and services:

The China Wealth Report 2022 shows that the proportion of financial assets in the asset allocation of Chinese residents is relatively low, with nearly 70% of physical assets. In 2021, the proportion of physical assets in China's total wealth reached 69.3%, with the majority existing in the form of real estate. Compared to leading overseas markets, the wealth management customer group in China has relatively weak financial management capabilities, and there is still significant room for optimization in asset allocation structure.

Therefore, Chinese wealth management institutions need to develop more innovative financial products and services to meet the increasingly diverse customer needs. This includes providing more customized and diversified investment portfolio choices, introducing advanced financial tools and strategies from the international market, and strengthening financial education and consulting services for customers, helping them improve their financial capabilities and achieve more effective asset allocation. Through these measures, the wealth management industry in China can better meet market demand, enhance overall service levels, and enhance industry competitiveness.

Strengthen technical and digital compliance supervision:

In terms of strengthening technological and digital compliance, the Chinese wealth management industry should also focus on the regulation of virtual currencies and related fintech products. With the popularization of virtual currency and blockchain technology, the wealth management industry is facing new challenges and opportunities. Regulatory authorities need to establish clear guiding principles to monitor the potential risks brought about by these emerging technologies, such as price fluctuations, fraudulent behavior, and related money laundering risks. At the same time, regulatory authorities should encourage wealth management institutions to develop safe and reliable digital solutions, improve service efficiency, and ensure the security of customer assets. By balancing regulation and innovation, the Chinese wealth management industry can better leverage the advantages of digitalization and financial technology while ensuring safety and compliance.

epilogue

Overall, the latest trends and policies in the wealth management industry in Luxembourg and Singapore provide important references for China. With the rapid growth of China's wealth management market, focusing on high net worth individuals, innovative products and services, strengthening technology and digital regulation will be key. These measures will help China's wealth management industry achieve more comprehensive development and better adapt to changes in the global financial market. Looking ahead to the future, China's wealth management market will have great potential!