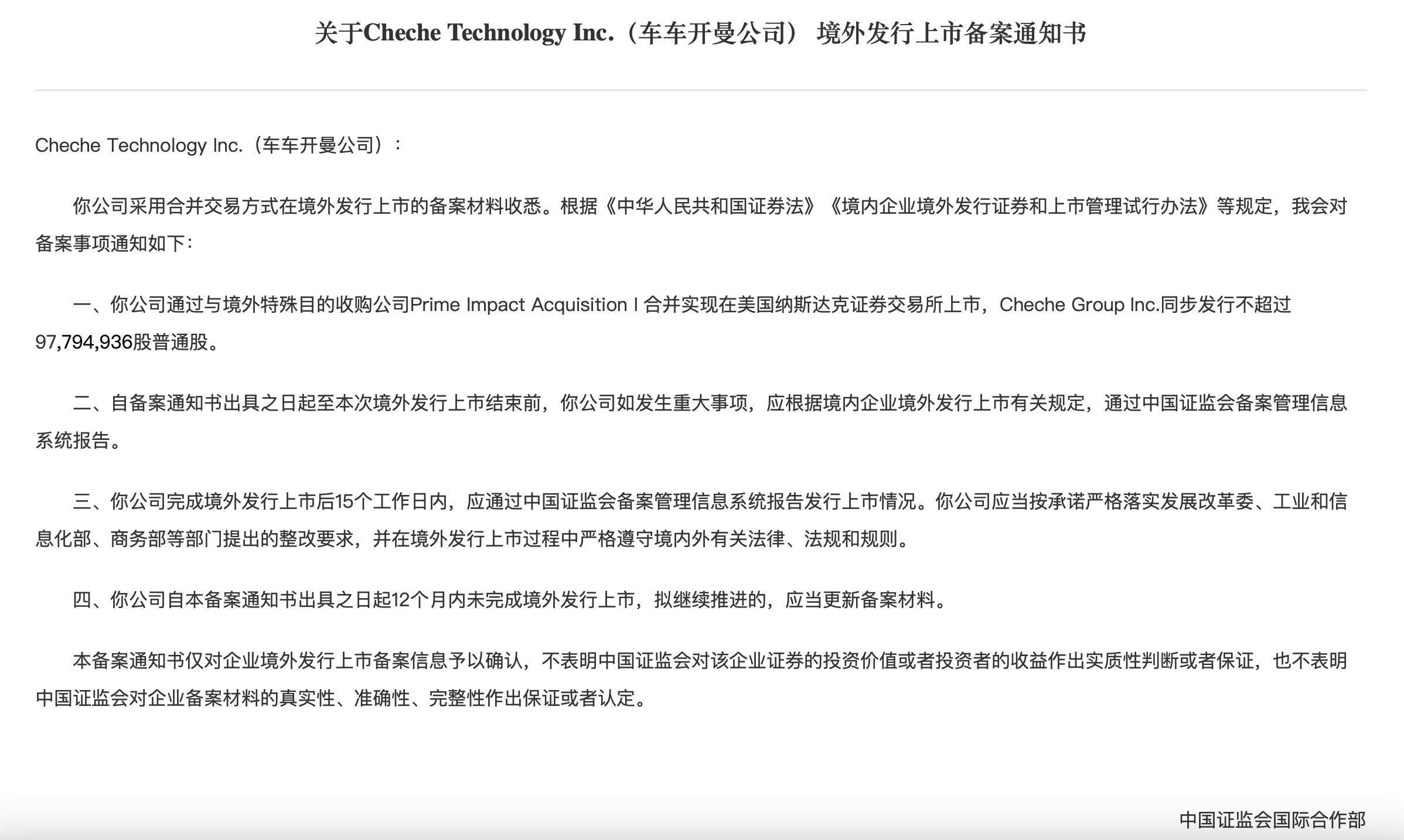

On September 19, the overseas listing of insurtech company Cheche Technology was approved by the China Securities Regulatory Commission. According to the notice issued by the China Securities Regulatory Commission, Cheche Cayman Company (Cheche Technology) will do so through the cooperation with overseas special purpose acquisition company Prime Impact Acquisition (PIAI) (PIAI) was listed on the NASDAQ Stock Exchange in the United States, and Auto Technology issued no more than 97,794,900 ordinary shares at the same time, and the combined listing code was CCG.

Cheche Tech opened at $11, peaked as high as $200, and finally closed up 582%, with a market value of $6 billion. Under the merger agreement, the combined company sold 1.8 million shares to investors at a price of $10 per share, and together with other proceeds of $4.1 million, the AutomotiveTech account is expected to generate $22.1 million.

Founded in 2014, founded by Zhang Lei, headquartered in Beijing, Cheche Technology has set up 130 service organizations in 28 provinces, autonomous regions and municipalities directly under the central government, and has R&D centers in Beijing and Guangzhou, and its wholly-owned subsidiaries such as Baodafang Technology Co., Ltd., Auto Insurance Sales and Service Co., Ltd., Che Che Zhixing Auto Service Co., Ltd., Huicai Insurance Brokerage Co., Ltd., etc., and has a national insurance sales license.

In 2022, Cheche Technology will start the listing process. At the beginning of 2023, Auto Technology signed a business combination agreement with PIAI, a special purpose acquisition company (SPAC) of NASDAQ and the United States, and the timing plan at that time was to complete the backdoor listing in the third quarter of this year. According to the announcement of the agreement, the pre-investment equity value of Cheche Technology is $760 million, and after the proposed merger, the new company is valued at approximately US$841 million at a price of US$10 per share, and the transaction is expected to generate total proceeds of approximately US$68 million for Cheche Technology, with the possibility of additional financing. On July 24, Auto Technology submitted the form for the first time, and updated the prospectus three times on August 8, 23 and 25.