On September 8, 2023, Zhibao Technology Inc. (hereinafter referred to as "Zhibao Technology Inc."), the holding company of Shanghai-based Zhibao Technology Co., Ltd., published a prospectus with the US Securities Regulatory Commission (CSRC) to list on the NASDAQ IPO in the United States, and it has submitted overseas listing filing materials to the China Securities Regulatory Commission on July 14 this year, and is in the full sprint stage.

The company's stock code is ZBAO, and the specific issue price, number of shares issued and amount of funds raised have not been announced. Company Profile Shanghai-based Zhibao Technology was established in November 2015. As a leading insurtech company in China, Zhibao Technology adopts the "technology + insurance brokerage" model, reshaping the definition of insurance brokerage services.

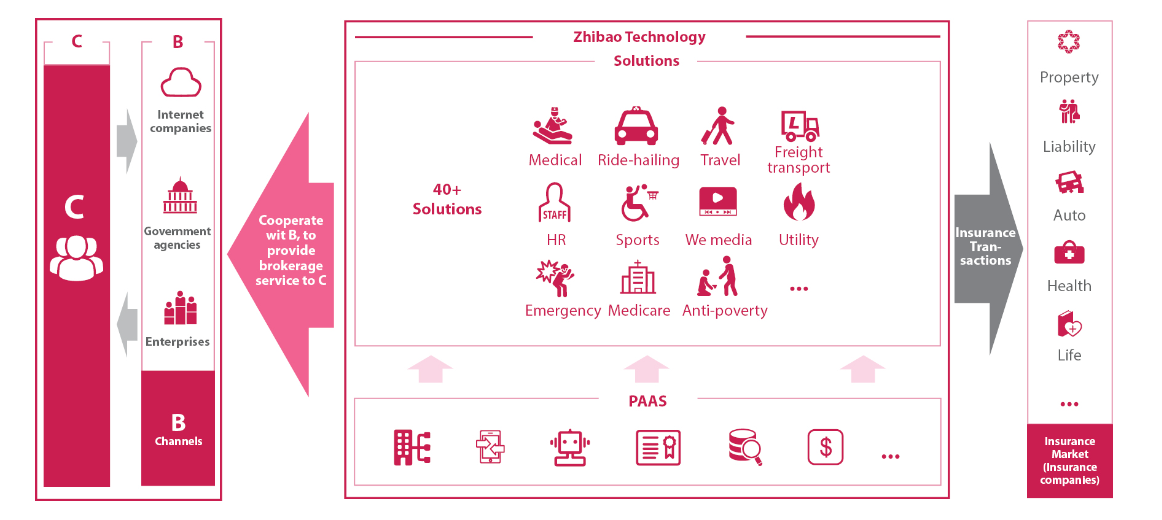

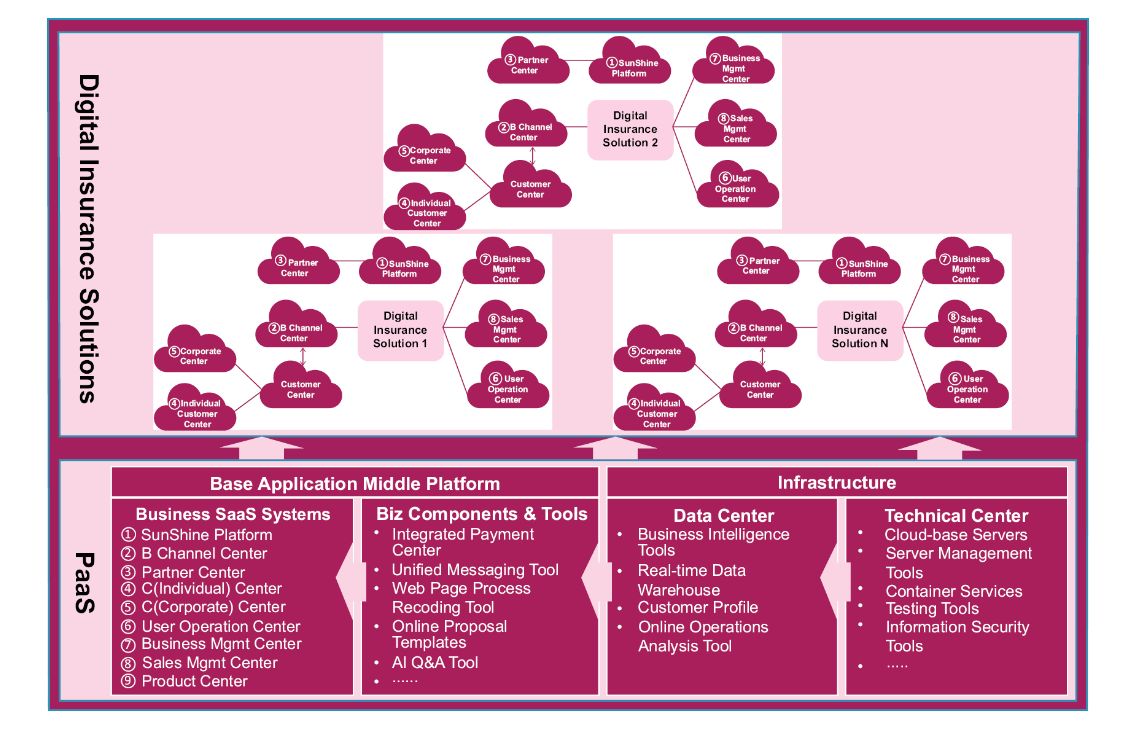

As a leader in the 2B2C insurance field in China, Zhimao Technology provides customized digital insurance solutions for B-end channels (including but not limited to Internet platforms, large and medium-sized enterprises, government agencies, etc.), which are perfectly integrated with the existing business matrix of the channel to provide digital insurance brokerage services for C-end customers. According to the company's official website, since its establishment, Zhibao Technology has provided a complete set of digital insurance solutions from operations, systems, insurance products to customer service for more than 1,000 Internet platforms, enterprises, governments and offline scenarios.

Main business and income

Insurance brokerage services

Based on the interests of policyholders, Zhibao Technology provides customers with digital insurance brokerage services and collects commissions in accordance with the law.

MGU services

Managing General Underwriter is a special entity in the insurance industry that usually has similar underwriting rights to traditional insurance companies, but does not directly bear risks. MGU is responsible for assessing, pricing and accepting risk, but when a policy gives rise to a claim, the actual risk is borne by the insurer or reinsurer behind it.

Business revenue

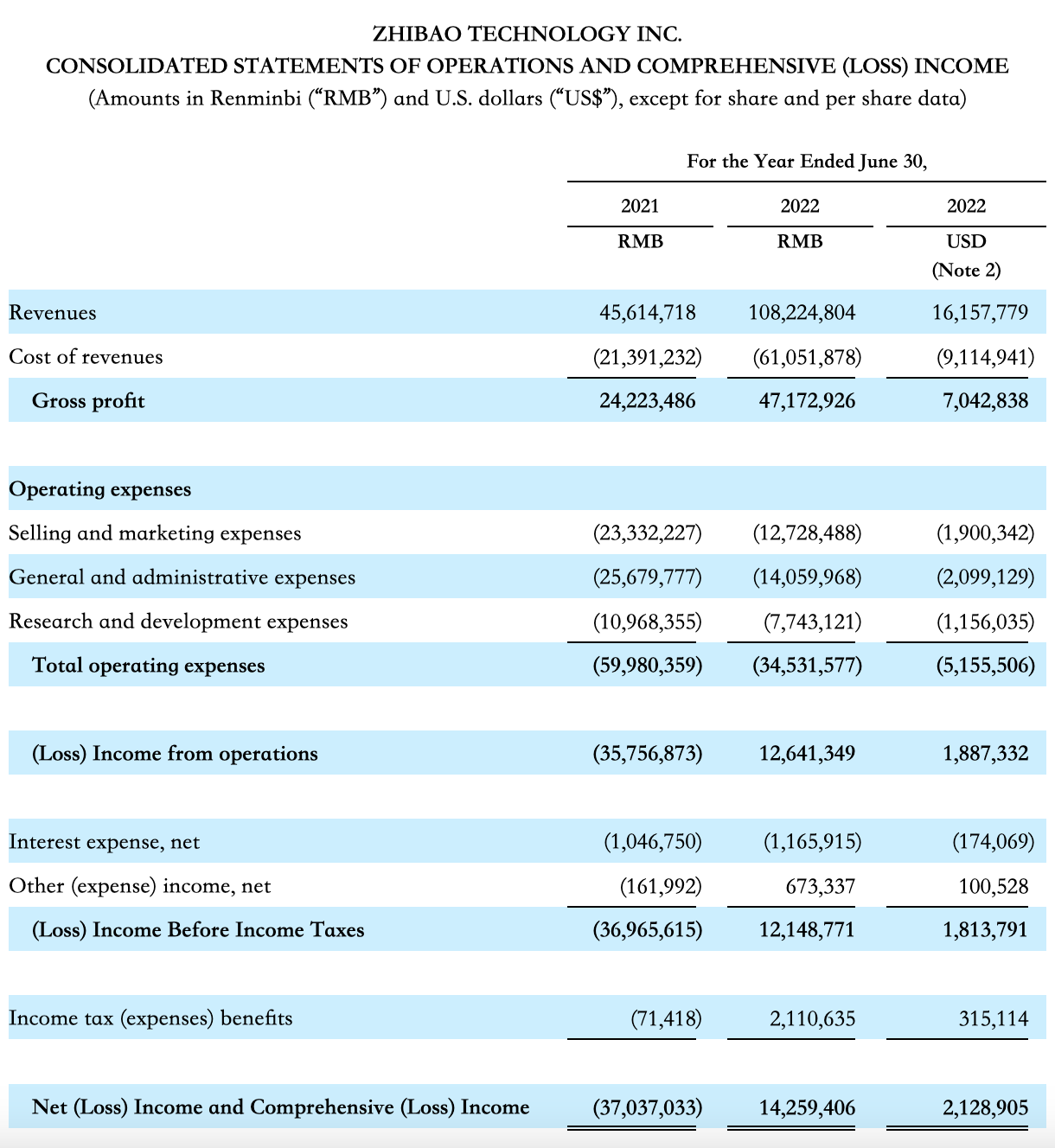

According to the prospectus, insurance brokerage services are the main business line of Zhibao Technology, accounting for about 75% of the company's total revenue. In fiscal 2021 and fiscal 2022 (fiscal year ended June 30), the revenue of Zhibao Technology was about 45.61 million yuan and 108.2 million yuan, respectively, and the net profit was about -37.04 million yuan and 14.26 million yuan, respectively.

Corporate structure and shareholding structure

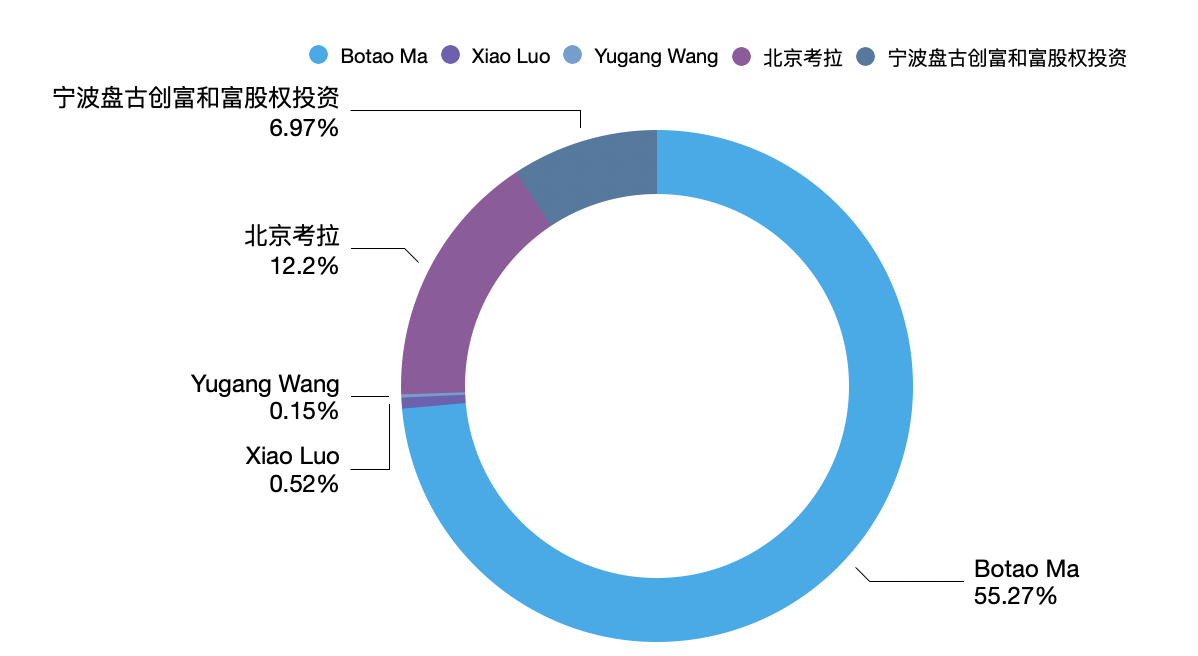

Shareholding structure

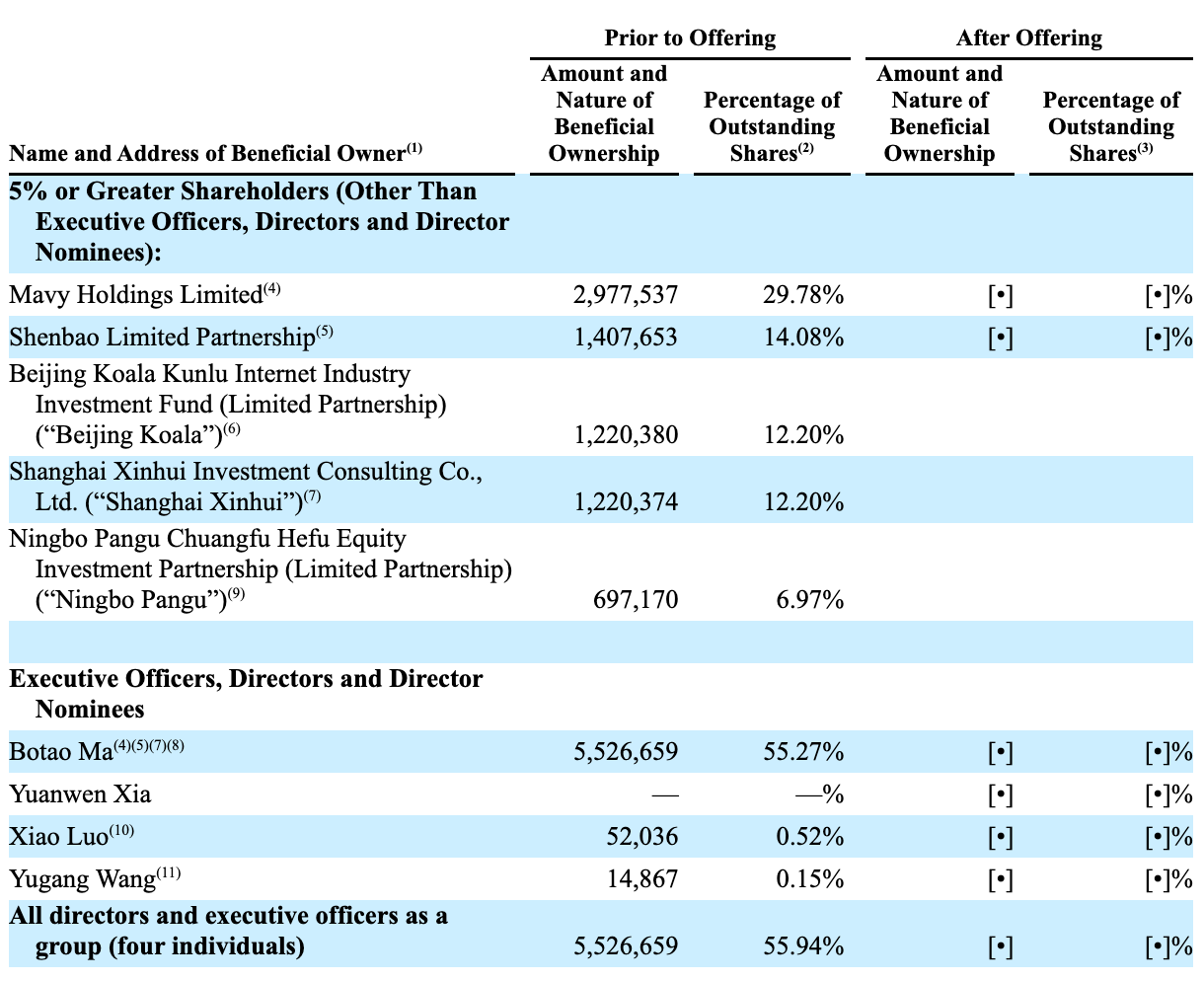

According to the prospectus, the shareholding structure of Zhibao Technology before listing is as follows: Mr. Ma Botao Ma, indirectly holds 55.27% of the shares of the company through Mavy Holdings Limited, Shenbao Limited Partnership and Shanghai Xinhui, controlled by the trust; Xiao Luo holds 0.52%; Yugang Wang holds 0.15%; Beijing Kaola holds 12.20%; Ningbo Pangu Chuangfu Hefu Equity Investment holds 6.97% of the shares

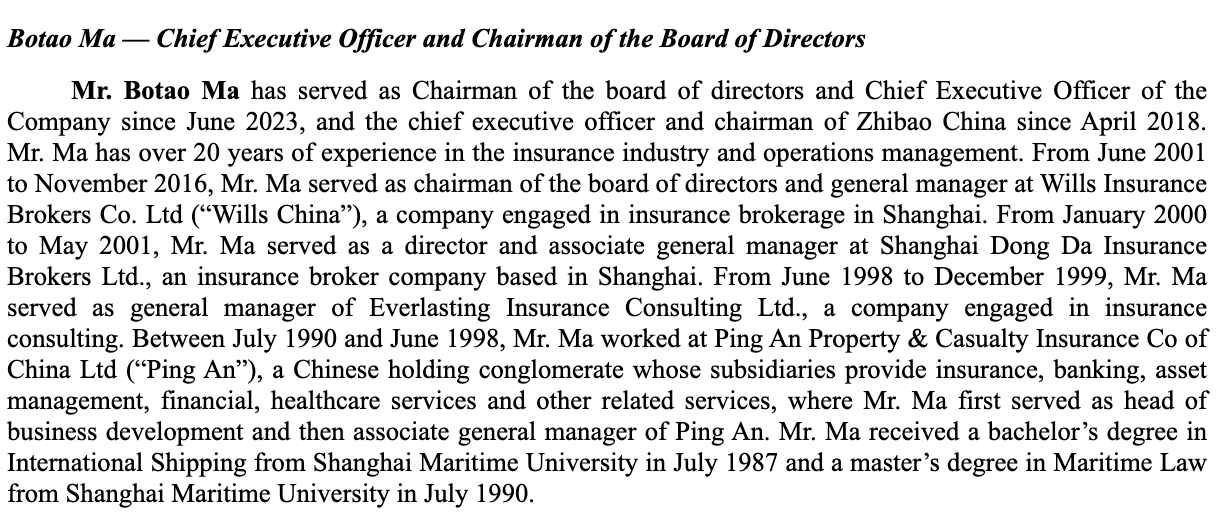

Managers Botao Ma - CEO

Yuanwen Xia - Chief Financial Officer

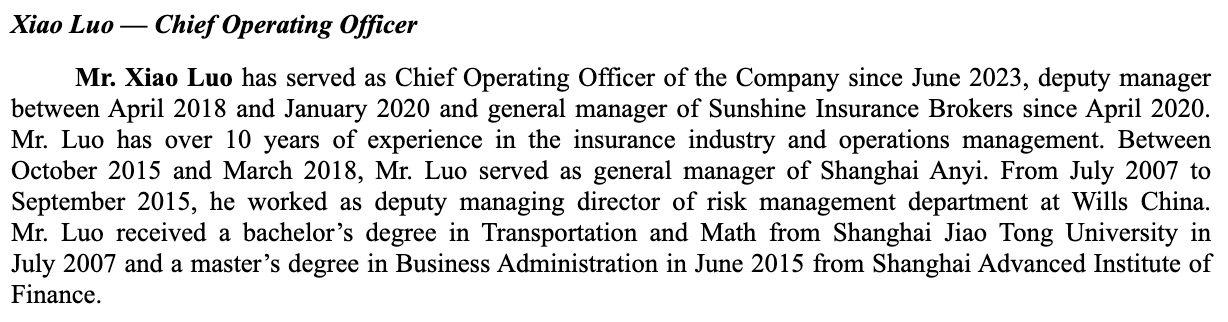

Xiao Luo - Chief Operating Officer

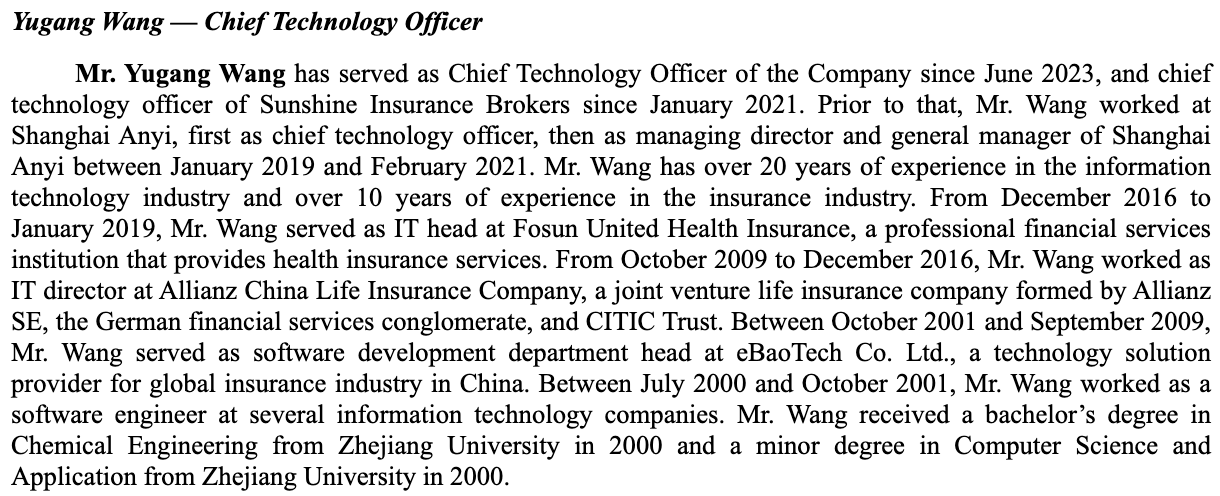

Yugang Wang - Chief Technology Officer

Michael A. Lucki - Nominee Director

Click on the link to view the prospectus of Zhibao:

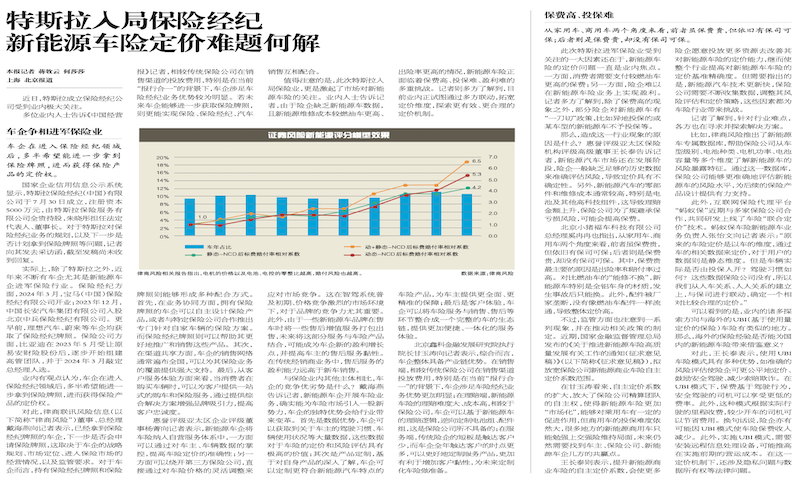

Tesla enters the insurance brokerage and how to solve the problem of new energy vehicle insurance pricing

Tesla enters the insurance brokerage and how to solve the problem of new energy vehicle insurance pricing