Private life insurance (PPLI) is an effective wealth management solution that is rapidly attracting the attention of affluent people around the world. Recent changes and implementation of the Common Reporting Standard (CRS) and the Exchange of Information Regulations have rendered the traditional fiduciary scheme somewhat ineffective. This affects high net worth individuals looking for legal planning solutions. The emergence of a new structure of private life insurance provides customers with a new way of thinking about family wealth management and intergenerational inheritance. Since its inception in the 90s, PPLI has been favored by ultra-high net worth individuals, and many well-known football stars, business celebrities and famous family businesses have paid great attention to PPLI and are willing to protect huge wealth for their successors.

definition

Private life insurance is a type of variable universal life insurance that is characterized by being offered privately and has a cash value, rather than a public offering. This insurance allows investments within the policy to defer the growth of income and capital gains tax. Ultimately, these deferred gains are tax-deductible income for death benefits upon the death of the insured. This insurance is an ideal wealth planning tool for wealthy families and high-net-worth individuals, capable of crossing different jurisdictions. Private life insurance, on the other hand, is a complex investment-linked life insurance contract that is offered through a private placement approach and can be customized to each client's unique needs. Customers can incorporate various assets, such as financial/wealth management assets, bank deposits, company equity, real estate, yachts, aircraft, famous cars, antiques, etc., into this whole life insurance policy with a policy-based structure.

peculiarity

1. Adaptation of high-net-worth people: Private life insurance is more suitable for people with annual income of millions and net assets of US$10 million or more due to its high one-time premiums and subsequent operating costs. In the United States, investors must be "accredited accredited accredited investors." According to the U.S. Securities and Exchange Commission (SEC), this type of investor has an annual net worth of at least $1 million (excluding the value of their primary residence) or an annual income of more than $200,000. Married couples are required to prove that they earned more than $300,000 annually for the previous two years.

2. Investment security and privacy: Under the private life insurance structure, assets are held by global insurance companies, ensuring complete ownership and independence from the insurance company's balance sheet. The client retains control and discretion to manage the assets as the asset manager of the portfolio within the policy. All investments are made in the name of the insurance company, the identity of the beneficiary, the insured and the policyholder is confidential, and the customer's investment is not restricted by nationality. In addition, the private placement life insurance structure can effectively circumvent the information reporting requirements of the CRS (Common Reporting Standard).

3. High investment flexibility: Private life insurance does not need to be limited to traditional insurance investment products such as mutual funds, and can invest in alternative investments such as hedge funds, private equity, and real estate. At the same time, private life insurance provides asset liquidity, and funds can be partially or fully withdrawn at any time to meet other investment needs.

4. Significant tax incentives: Investment accounts of private life insurance can defer revenue recognition and avoid virtual income tax. Achieve compounded growth in investment income through long-term income tax deferral. HNWIs can also exempt them from potentially high estate tax by using a combination of instruments such as private life insurance and insurance fund trusts to exclude insurance money from taxable estates.

5. Stable wealth inheritance: Private life insurance is separated from ordinary property, and the beneficiary can be freely selected, and the insured will be paid directly within 30 days of death, without the need for distribution certificate or probate. Compared with the high cost and complex procedures of traditional probate undertaking, private life insurance can achieve high efficiency and cost savings by designating beneficiaries and releasing assets in as little as a week. Its high confidentiality is conducive to the privacy of wealth inheritance, and there is no need to disclose the content, effectively avoiding wealth disputes, and better reflecting the holder's inheritance will.

Mode of operation

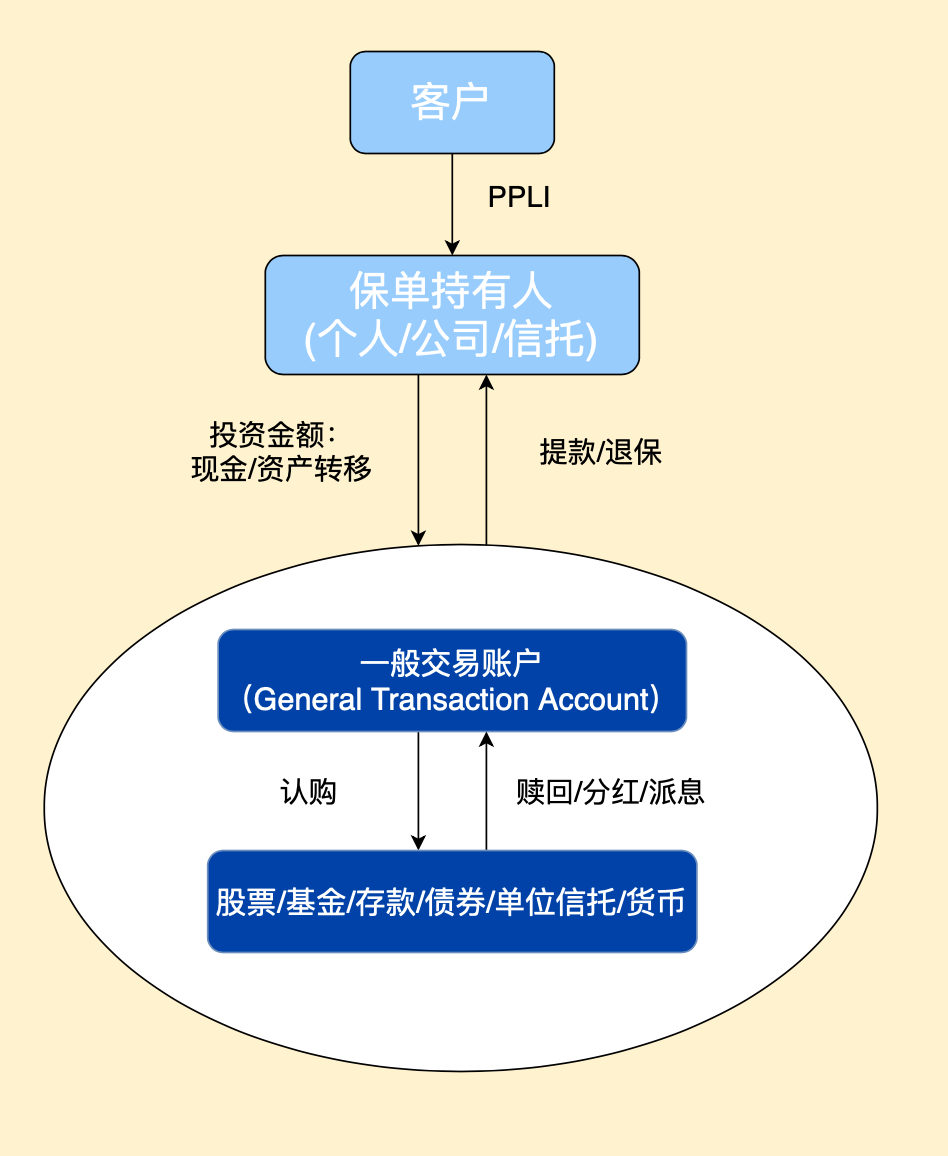

Insurance companies issue policies to policyholders as individuals or legal entities, The policyholder can decide the beneficiary or insured person according to his own insurable interests; the policyholder transfers the approved assets to the insurance company and pays the premium; The insurance company appoints an investment manager who will have full discretion to manage these assets in accordance with the investment strategy and guidelines agreed with the policyholder, which will be protected by a custodian bank; Policyholders can withdraw funds at any time, or pledge the portfolio in exchange for a loan; if the insured dies, a benefit payment to beneficiaries is initiated, which usually does not require distributions or probate. For people Private Placement Life Insurance (PPLI) is for people with annual income in the millions, net worth of $10 million or more, or control of businesses that place them in this category, and individuals or families interested in tax-efficient investments and investment strategies . PPLI has a number of important tax benefits, which may be a major consideration for those in the highest tax brackets. High net worth individuals who are global citizens, who or their family members live or work overseas, are always looking for a tax efficient structure that is globally recognized and beneficial to the beneficiaries. PPLI is one such structure that allows policyholders to accumulate global assets on a tax-deferred basis and enjoy tax benefits when paying their worldwide estate to beneficiaries as life insurance death proceeds. For HNWIs with offshore entities, their offshore entities need to comply with the definition of economic substance as part of the Common Reporting Standard (CRS). Offshore entities that do not meet the requirements will be considered controlled foreign companies (CFCs). Each country has its own CFC regulations, but most are similar in that they primarily target individuals who have control in offshore companies.

Summarize

Private placement life insurance is a wealth management solution widely adopted by wealthy individuals around the world. As a variable universal life insurance policy, it provides private services and has a cash value, investment income and capital gains tax deferral within the policy. These deferred benefits are tax-free upon the policyholder's death. For people with high annual income and substantial net assets, PPLI provides a new family wealth management and inheritance method, and its advantages include investment security, privacy protection, flexible investment and tax incentives. However, when planning and allocating assets, customers also need to consider various factors such as their own tax status, the laws and regulations of the location of assets, and the tax status of beneficiaries. No investment tool can perfectly solve all problems.

Disclaimer: We take a neutral attitude towards the opinions in this article. This article is for reference and communication only, and does not constitute any professional advice or service. The Institute shall not be liable to any party for any loss arising from the use of this communication.

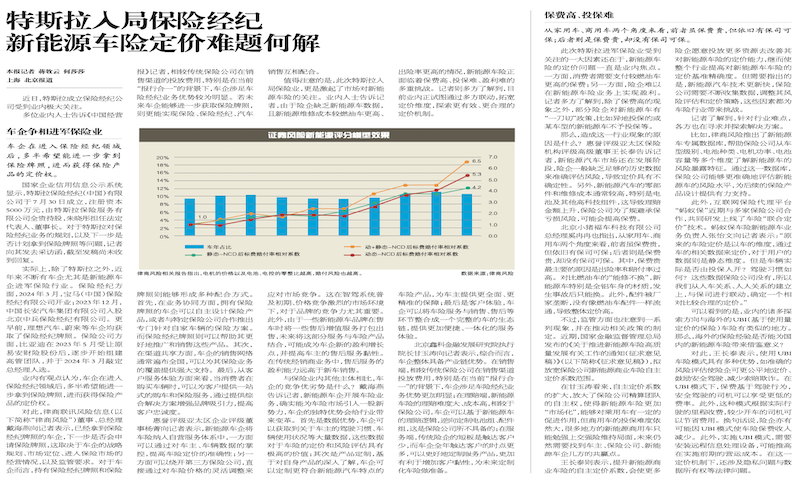

Tesla enters the insurance brokerage and how to solve the problem of new energy vehicle insurance pricing

Tesla enters the insurance brokerage and how to solve the problem of new energy vehicle insurance pricing