Summary:

According to the international empirical method, the scale of agricultural insurance premiums in China will exceed 160 billion yuan in 2025, and reach 600 billion-1,000 billion yuan in 2035. At the same time, as the proportion of agricultural insurance in the property insurance business gradually increases, it will become the second largest non-auto insurance type of property insurance companies in 2025, and the development of agricultural insurance will usher in great opportunities in the future. In the context of this era, this article will focus on how technology can help agricultural insurance underwriting claims to be true and accurate, how to help agricultural insurance business go online, how to improve agricultural insurance optimization service processes, and how to

1 how technology can help agricultural insurance underwrite claims to be true and accurate

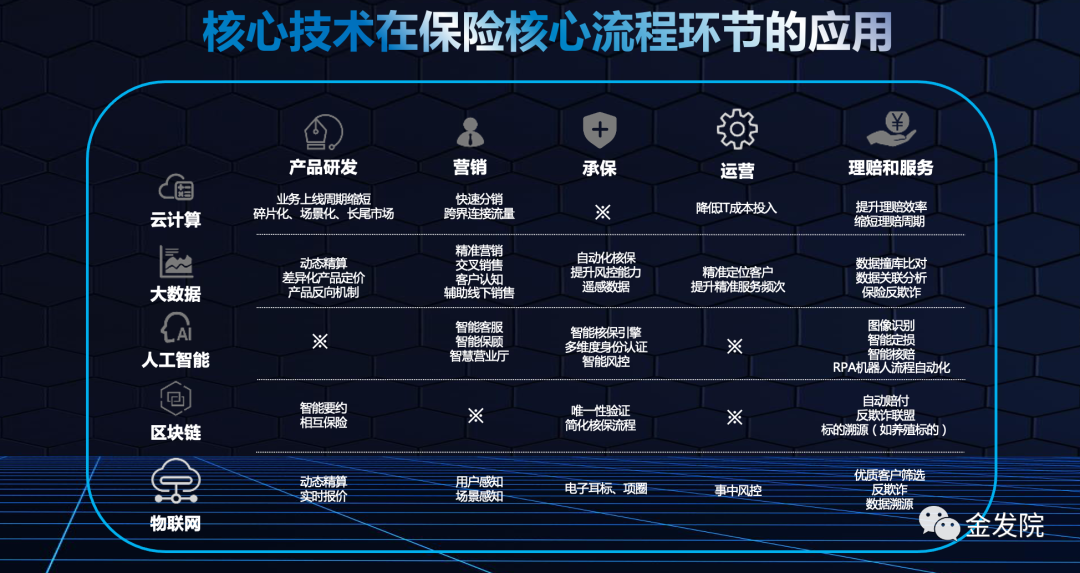

In recent years, the underlying technologies including 5G communications, artificial intelligence, big data, Internet technology (mobile Internet, Internet of Things), distributed technology (cloud computing, blockchain), security technology (cryptography, quantum technology, biometric technology) and other underlying technologies have continuously made major breakthroughs, and have developed rapidly in the application field, providing a strong technology-driven technology for the introduction of new technologies, new formats and new models to empower the transformation of the financial and insurance industry.

Underwriting side - technology-enabled prevention of false underwriting

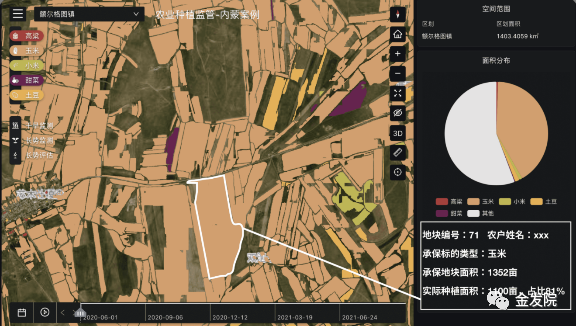

Through remote sensing technology (RS), geographic information system (GIS) and global positioning system (GPS) (referred to as "3S technology") combined with crop multispectral characteristics, before the underwriting work begins, off-site non-contact field crop identification (the accuracy of the identification result is 90%+), the identification result, that is, the sown area and spatial distribution of field crops, are displayed in the form of maps, and superimposed with the results of the national basic farmland survey to generate a map of the actual field crop sowing of farmers. The agricultural insurance agency confirms the insured area with the farmer according to the field crop sowing map to prevent false underwriting.

Underwriting side - AI, blockchain and other technology applications to improve underwriting efficiency

When underwriting agricultural insurance, property and casualty insurance business personnel collect customer basic information, online publicity, electronic signature, online payment and other operations through PDA, and can complete online insurance application in a few minutes, based on OCR recognition, face and other biometric technologies can quickly identify customer information, simplify the process of information entry and so on.

Claims side - technology-enabled control of false claims

For planting/forestry insurance species, with the help of "3S technology" and the application of crop growth model in the event of a claim accident, an off-site non-contact loss analysis is carried out on the planting/forestry after the disaster, and the loss is estimated according to the three degrees of light, medium and heavy or according to the loss level of one unit every 10%, and the agricultural technical experts then verify the detailed loss ratio on the spot according to the loss assessment results, so as to prevent the occurrence of false claims.

Claims side - the application of science and technology starts from the traceability of the breeding insurance target to ensure true and efficient claims

In the agricultural insurance claims link, the automatic measurement of body length and remote video survey realized by the identification technology can quickly and scientifically determine the loss, provide high-quality, efficient and safe remote services for the majority of farmers, and let the small cases of aquaculture insurance "flash compensation" arrive.

Farmers self-help use of the watermark camera function attached to the Mini Program to take photos of the spatial information of the target when the risk is taken, and the harmless processing process of claims can be remotely operated online and saved by the image upload system. Ensure efficient, smooth and fast claims services.

2 how science and technology can help the agricultural insurance business online

With the wave of the digital age, science and technology is constantly helping agricultural insurance to move towards the goal of full-process and online, and technological progress and regulatory dividends have created opportunities for the digital transformation of agricultural insurance. At the same time, challengers such as domestic and foreign countries and Internet giants are also accelerating the layout of insurance and technology, and promoting the integration of insurance and technology. Apply digital technology to the insurance industry, accelerate model innovation and process reengineering of the entire insurance industry, and build a digital ecology of the insurance industry.

A variety of supporting activities to explore the path of high-quality financial development

Realize the whole process of underwriting business such as underwriting information collection, explanation obligation performance, underwriting publicity, insurance policy issuance, policy correction and so on

In the future, through Internet technology and Internet channels, in the traditional and emerging fields with the focus on "strict selection + customization", the system control of agricultural insurance underwriting will be realized, and the underwriting process can be traced and audited, so as to achieve simpler product purchase, richer product supply, more efficient customer reach and better service.

The ultimate service experience on the claim side will become the core element affecting customer acquisition, compared with the pain points such as complicated processes, long processes, and inadequate payments in traditional offline claims, the wide application of new technologies will greatly improve the timeliness of claims and customer experience.

In terms of service industry, agricultural insurance technology innovation will promote the improvement of regulatory level and the healthy development of the industry

In the past few years, although the insurance industry has continuously transformed all aspects of insurance sales, underwriting, claims and other aspects through technology, the digitization of the entire operation process is still a great challenge for traditional insurance. At the same time, the rapid growth of the scale of premiums and the level of regulatory technology and the mismatch and mismatch in risk and compliance awareness have also caused industry problems such as misleading sales and difficulty in settling claims.

In the future, as insurance technology innovation extends from a single node to insurance supervision, insurance enterprises and upstream and downstream enterprises, the operational efficiency, openness and transparency of insurance underwriting, claims settlement and insurance services will be greatly improved. At the same time, regtech will develop rapidly at the same time, and problems such as misleading sales and difficult claims settlement will be effectively solved.

In terms of empowering insurance companies, agricultural insurance technology innovation will promote the business model reform of "scene linking and product service innovation"

In recent years, big data, cloud computing, mobile Internet and other basic technologies for the development of the insurance industry to provide strong technical support, the rapid development of agricultural insurance technology and continuous changes in insurance companies' marketing scenarios, marketing tools, communication efficiency, service chain, etc., in the past to "channel control" based on the sales and service methods, to "scene link and product service innovation" to promote business model change; At the same time, agricultural insurance technology is also constantly expanding the boundaries of insurance services, emerging products continue to penetrate into a variety of production and life scenarios, the traditional insurance enterprises, intermediary channels and scene parties have formed a greater challenge, how to better promote the application of science and technology, series scenarios and coordinate the upstream and downstream resources of the industrial chain, has become the key to insurance technology innovation in a single vertical field and the overall differentiated competitive advantage.

3 How technology can improve the service process of agricultural insurance optimization

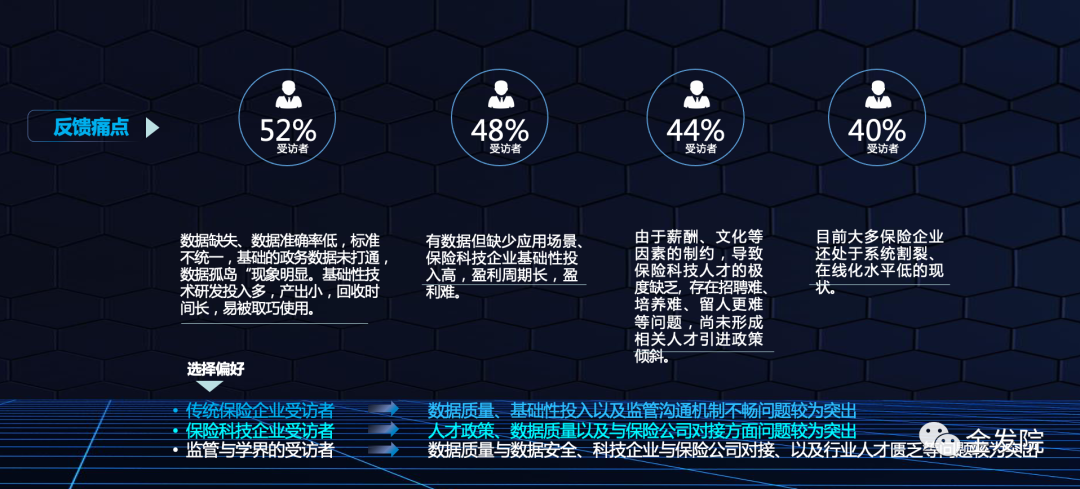

The integration of technology and insurance, from the initial electronic and informatization of insurance, to relying on Internet scenarios and mobile scenarios for insurance sales, to using a series of technologies such as big data, cloud computing, and artificial intelligence to empower the insurance value chain and improve operational efficiency, By changing product forms and service methods, transforming business models, and creating a new insurance ecosystem, insurance technology innovation has transformed from single-node innovation to enabling the digitalization of the entire insurance chain. According to the questionnaire survey of relevant industries, artificial intelligence, big data, and knowledge graphs are the core elements, and data, talents, and technology investment are the prominent pain points in the current development of insurance technology. To this end, finding the empathy and common ground between the two endowments of insurance and technology is the key.

Solution idea 1: build an industry sharing platform

By analyzing the past development of the insurance industry and combining the pain points of the industry, the next step can be to establish a common dialogue mechanism between insurance companies and insurance technology companies through the leadership of the regulatory authorities, and create a sharing platform for equality and exchange.

Solution idea 2: looking for a win-win situation

Promote the iterative development and model optimization of core elements, and find a win-win point between the main insurance business empowered by insurance technology and the cost reduction and efficiency increase of insurance companies.

Solution idea 3: cultivate scientific and technological talents

Through the establishment and improvement of the insurance technology talent training mechanism, more translators can be trained to accurately identify the needs of the main insurance business and the technology empowerment tools, helping to form a benign research and development, cooperation and feedback mechanism between the two, and maximizing the release of the efficiency of insurance technology.

4 the application practice of unmanned aerial vehicles in insurance: determination of plots and loss areas, growth status monitoring

UAV agricultural remote sensing technology has the advantages of strong mobility, high resolution and low equipment cost; Compared with the ground perception method, it has the advantages of wide range, fast speed and low labor cost, and has broad prospects for development.

Drones - agricultural remote sensing technology to determine the land area:

UAV aerial photography has a high degree of automation, can automatically set up flight aerial survey plans, provide more DOM results, rural collective land registration and confirmation of rights certification work is a national key project, UAV aerial photography data can detect the quality of work progress;

After the completion of land mapping, the data collected by aerial photography of unmanned aerial vehicles can generate three-dimensional visualization data such as DEM, three-dimensional orthophoto imagery, three-dimensional oblique imagery, three-dimensional landscape model, three-dimensional land surface model, etc., and draw topographic maps with large scales to assist in the calculation and verification of rural collective land registration and right issuance.

Unmanned Aerial Vehicle - Dynamic Perception Technology of Farmland Environment Based on Machine Learning:

The perception technology for the field operation environment has become a necessary condition for the autonomous operation of agricultural drones. Apply intelligent photoelectric detection and pattern recognition methods to obtain key information such as basic scale characteristics and type attributes of various non-operational targets in the environment.

Online observation of static features and dynamic motion trends of various objects in the environment

The intelligent pattern recognition method based on machine vision and multi-sensor fusion can effectively solve the problem. For example, in hilly or terrain undulating areas, the relative height information of the crop canopy and the UAV is very important to the operation effect and flight safety. The new microwave radar sensor and multi-sensor fusion methods such as barometric altimeter, GNSS, and inertial measurement unit can be used. Effectively measure the height of the UAV body relative to the ground and the crop canopy, and realize the imitation of the ground tracking flight.

5 Development proposals

Government Regulators:

Insurance regulators should establish a supervision and guidance mechanism that matches the development of the insurance industry to escort the scientific and technological innovation of agricultural insurance.

Traditional insurance companies:

Based on the industry characteristics and market positioning of agricultural insurance, traditional insurance companies should meet regulatory requirements when innovating, be consistent with the national strategy, and incorporate the development of the industry into the trend of national digital transformation.

Innovations in mechanisms, models and applications are particularly important for the digital development of the traditional insurance industry.

Technology Startups:

Don't talk about subversion, we must integrate into the ecology, and truly realize the coordinated development in the ecology of the main business of agricultural insurance. Mr. Save and then seek development, first do business and then build scientific and technological capabilities, pay attention to scientific and technological capabilities is a continuous investment.

Editor's Note:

Technology can not only calculate the trajectory of the ballistic trajectory, but also calculate the best path for takeaway...

Technology is a gun, but also a rose;

Sometimes people went on expeditions with guns and abandoned the rose garden; Sometimes people are addicted to gardening, but their homes are trampled on by iron hooves...

And we want insurtech to shine with the light of goodness, in those great stories, people holding steel guns and flowers blooming behind them. It allows ordinary people to attain happiness, peace, courage and dignity in their years.